Host: Len Clements, MarketWave, Inc. Founder & CEO

Podcast #21: Zeek Rewards

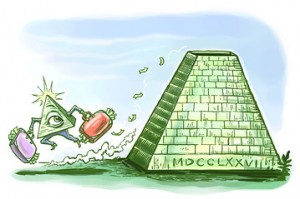

Pyramid, Ponzi, and Investment Schemes

Is One Hiding Behind Your MLM Program?

By Len Clements © 1997

Pyramid, Ponzi and investment schemes disguised as legitimate MLM programs continue to flood the U.S. market. But unlike their predecessors, they’re hiding their true nature better than ever. Many quasi-pyramids and money games today are taking great advantage of the ignorance of most people as to what constitutes an illegal pyramid. Please understand, I do not use the term “ignorance” derogatorily. The term comes from the word “ignore” and many of us are simply ignoring a few basic, simple facts that make up a composite of a typical pyramid or other such scheme. Also, understand that I am not an attorney, an attorney general, or a postal inspector. But I know what questions they ask – and so should you! Also, as I describe the legal definitions of these various kinds of schemes I’m going to use plain English. For example, where the proper legal language might refer to the payment of “consideration,” that being anything from gold dust to chickens, I’m going to assume that it’s safe to just say money. If you want all the verbose legalese, call a lawyer.

Let’s start with the ol’ classic – the Pyramid Scheme.

By definition, a Pyramid Scheme is one where there is some kind of direct financial reward for the act of recruiting another person into the scheme. A blatant pyramid scheme would involve no product at all. You simply pay a chunk of cash to play, and hope you recruit enough others to cash out, usually for several times what you originally invested.The roots of most pyramid/MLM law is founded on the Amway vs. FTC decision in 1979. Perhaps the single most defining characteristic of a legal network marketing company vs. an illegal pyramid scheme came from these hearings. Essentially, the question was asked… “Can the last person in still make money?”

Obviously, the last person in a pyramid scheme will never make a dime. But if you were the very last person to ever sign up as a distributor for Amway, or any number of other legal MLM operations, could you still make money? Of course. By buying the product at wholesale and selling it at retail. The last person in, with no recruiting, can still make money.

If you were the last person to sign up in your MLM program, could you reasonable expect to be able to mark up the product or service and resell it to an end user? That is, someone who only wants the product or service? Are you, and your downline distributors buying the products because you genuinely want them, or are most of the distributors making token purchases simply to satisfy a quota in the compensation plan? Having real products of value to an end user is a key element of a legal MLM enterprise.

Having said that, one of the most common, and least accurate questions you can ask in determining if something’s a pyramid scheme is simply asking, “Is there a product.” Almost every pyramid out there today has thrown in some kind of token product knowing you’ll ask that question. Some extremists will go so far as to tell us that the “service” they provide in exchange for your fee is their administration of the intake and outgo of cash. Some will claim you are paying to have your name added to a mailing list. Of course, the typical chain letter leads you to believe you are paying for a report of some kind. However, there are literally dozens of schemes out there that are not nearly as obvious. Some offer what appears to be an abundance of bona fide, tangible products. But again, the focus should be on value and motive.

One of the best examples I can recall was a program called The Ultimate Money Machine. For $350.00 you were to receive such items as luggage, a 35mm camera, and a seminar on cassette tape valued at, of course, hundreds of dollars. Well, the camera was a cheap, plastic job that probably had a value of less than $10.00, and the luggage you unrolled from a tube. Total cost to the company forall of these products was probably less than twenty bucks!

A program called Euro-Round required a $100.00 payment in exchange for nothing. Later, to “make the program legal,” they added a little book.

Schemes like Investor’s International, CommonWealth, Global Prosperity, Delphin, and it’s various other incarnations, would have you buy some literature and a few cassette tapes, with a material cost of around ten to twenty bucks, for usually about $1,250. There rationalization is that “Information is priceless!” Okay. Let’s (reluctantly) give them that. But such schemes usually withhold a larger and larger portion of your income to qualify you in subsequent stages, or cycles, and these funds are allegedly for the purchase of, usually, a live seminar on some Caribbean island. At the top stage you might end up paying as much as $100,000 for a seven day seminar in Belieze. It better be catered!

A few companies today still offer product vouchers or certificates that can be spent on items out of a catalog or from various local merchants. They are actually only offering the funds to purchase these products. There is usually a commission paid once the certificate is purchased, even if it is never redeemed. The result? Nothing but paper, most of it cash, being exchanged. There is a great deal of recent legal precedent in this area. The upline shouldnever be paid out of any kind of down payment, layaway, voucher purchase, or any other similar transaction that does not involve an immediate acquisition of a product or service of value. In other words, no one should get paid until an actual product gets shipped.

As to “motive,” again, are you and others buying the product because you want that product or can sell that product, or are you buying it because you have to to make money? For example, if a company pays commissions on sales aids or distributor training, which several are doing as of this writing, this creates a legal vulnerability. Obviously, you can’t mark up a product brochure, distributor manual, or distributor training course, and resell it to someone who’s not a distributor. Obviously, you would never have purchased any of these items if you weren’t a distributor yourself. These are sources of income that can only be derived from recruiting because recruits are the only ones that would ever purchase them.

So don’t just ask if there is a product involved. Question whether the product is even close to being worth the overall price paid. You don’t have to be an economics genius to know the answer. Just ask yourself this question: “Would anyone realistically ever purchase this product or service without participating in the income opportunity?” Thousands of people purchase products from such companies as Nu Skin, Watkins, Herbalife and Amway every day without becoming distributors. They just want the product. This is true for most of the MLM companies out there. But certainly not all.

So, now how exciting is that big ad you just saw that boasted “NO SELLING!” Consider it a big red flag.

Now let’s discuss Ponzi Schemes.

First of all, no, a Ponzi is not the same thing as a Pyramid, although Ponzis are often referred to as a pyramid. In a pyramid scheme, you pay in X, the pyramid promoters keep, let’s say, 20% of X and use the other 80% to pay all those who “cash out.” Not unlike legitimate MLM operations, a distributor can earn far in excess of what they personally paid in, but the MLM company itself never pays out much more than 40-50% of every wholesale dollar that comes in.

In a Ponzi scheme, you pay X to the promoter who promises that you will receive a certain specific return, say 2X (twice your investment) back in a few days. The promoter accomplishes this by finding another sucker who’ll buy into the same promise, and he then uses the second suckers investment to pay off the first’s.

As an example, let’s use Carlo Ponzi himself. Back in the early 1920’s, Ponzi offered a $1,500 return on a $1,000 investment. When sucker A paid him $1,000, he then got sucker B to believe the same pitch and invest another $1,000, then took $500 from B’s money to add to A’s original investment, and paid A back his $1,500! Of course, a modest “service charge” was retained by Ponzi. With only $500 of B’s investment still in hand, Ponzi now needed to find sucker C so he’d have another $1,000 to add to the $500 he already had, and then pay sucker B his promised $1,500. Now, he had to find yet two more suckers to have the funds to pay off sucker C. And so on, and so on.

Ponzi accumulated millions. He died a penniless ex-con.

Ask yourself this question about the program you are evaluating: “If all recruiting stopped today, would this company still be able to pay monthly commissions in the months ahead?” Although there may be no pyramidal hierarchy involved, a Ponzi Scheme does involve the need for a never ending flow of new participants making the initial investment. This also falls, once again, on the value of the products. If not one new person is ever again enrolled as a distributor, could sales volume realistically continue to move through the organization?

But there’s more to consider. Let’s say a company has great products that people love and would continue to purchase even if they didn’t make money. However, for every wholesale dollar they pay to the company, the company pays $1.05 back to the distributor force in commissions and bonuses. In other words, their compensation plan has a 105% pay out! Technically, if they really did pay out more than 100%, this would be a Ponzi Scheme. The company must sell one more product to be able to cover the compensation for the previous sale (otherwise, they’d be 5 cents short). And there are a number of MLM deals today that claim to have such exorbitant pay outs. In reality they most likely do not. Probably not even close. For example, one MLM program claims a 112% pay out, but the percentage is based on the point value of each product (called BV, or Bonus Value), not on the actually dollar amount – and the BVs average about 68% of wholesale dollars. Another company promotes a 109% pay out, but usually forgets to mention their 75% BV ratio, and the fact that the 60% they pay on the first two levels (15% and 45% respectively) is only on the first $300 purchased by each distributor during the month. The pay 5% on all the volume over that. Yet another company claims a pay out that actually exceeds 200%! The catch is, they pay a higher percentage on those you personally sponsor, and the pay out they display in their ads is based on the wholly absurd scenario that every single person in your downline is personally sponsored.

So, just because someone says they pay out more that they take in (over 100%), doesn’t necessarily mean they are running a Ponzi Scheme. There’s very likely a catch. Still, considering state and Federal regulator’s penchant for taking on a guilty ’till proven innocent attitude (they attack first and ask questions later), I’m curious as to why these companies would want to even create theillusion that they are paying out more than 100%. Why would they even want to pretend they are a Ponzi Scheme?

Lastly, let’s discuss “Investment” Schemes.

The three regulatory agencies we need to be concerned with the most, from an MLM opportunity stand point, are the Federal Trade Commission (FTC), Food & Drug Administration (FDA), and the often underconsidered Securities & Exchange Commission (SEC). From a personal, independent contractor stand point, you have the IRS to worry about as well. But that’s another article. You’ll likely never have to contend with either the FBI or FCC – unless, of course, that “sense of well being” you get from your herbal product is derived from a South American poppy, or you enroll Howard Stern as a distributor.

Getting back to the SEC…

“Securities” are basically things you invest money in, like stocks, bonds, mutual funds, commodities, and so on. You have to register the securities you sell with the SEC and you have to have a license to sell them. Skip either step and you might be going away for a little while.

In 1946 (as part of the SEC vs. W.J. Howey Co. decision) the Supreme Court defined an investment contract as one where “…the scheme involves an investment in a common enterprise with profits to come solely from the efforts of others.” (The word “scheme” is used here, and throughout this paragraph, in a basic, non-derogatory sense). So, there’s three things to consider: First, is there money being paid into the scheme (an investment)? Second, are there a lot of other people paying money into the same scheme (a common enterprise)? Note that, so far, every MLM operation appears to meet the first two criteria. But the third test is where we depart, or should depart, from a security – is the money you make from the scheme derived “solely from the efforts of others?” Well, I don’t know about you, but I work my tail off about 50 hours a week building and managing my downline! Sure, your time investment ideally forms a bell shaped curve (part time, then full time, then eventually back to part time), but there should always be a mandatory effort on your part to build, manage and support your organization.

This, of course, does not bode well for schemes (I’m using the negative connotation now) where you pay a “downline building service” to build your downline for you. It appears to be undebatable that all three aspects of the “Howey test” apply to such a deal. You pay money to the same promoter that many others are, and they openly promise to do all the work for you and you simply sit back and cash the checks. No, there has not been a lot of legal action against such schemes because, well, they have a 100% failure rate all on there own!

In closing, I want to make it clear that this article is not necessarily based on the author’s opinion of the way it should be. Much of this discussion is based on years of precedent, not just my laymen’s interpretation of the law. It’s simply the way it is. For the record, I am a Libertarian. Personally, I believe we, as adults, should be allowed to do what ever we want with our own money as long as there is full disclosure and we are made aware of all the risks involved. We’re spending the half our government lets us keep. It’sour money! In fact, I’ll go so far as to say I personally feel pyramid schemes should be legal. Not providing full disclosure about the risks and lying about the potential benefits should be against the law – and, in fact, already are! If all this information is provided, then we should have the right to be stupid with our own money.

Having said that, rules are rules. And until someone changes them, we’ve got to play by them.

My soap box is cracking. I’ll step down now.

Personal Consumption and the 70% Rule

Recent Regulatory Misinterpretations Can Be Harmful to Distributors

By Len Clements © 1999

The serious challenge that has arisen in recent years involves the interpretation of the 70% Rule. Previously, the “or consumed” provision in the above definition has received little or no resistance. In fact, this has been generally accepted without incident or harm for the entire 20 year period since the Amway decision. However, for some unknown reason (although many theories abound) several actions have been taken recently in which the “or consumed” aspect has been thrown out. The judge or regulatory body has demanded that 70% of all previous wholesale purchases be retailed to non-distributors only. Furthermore, they have ruled that no commission, bonuses or overrides be paid on product personally consumed by the distributor!

Perhaps the most publicized case involves the Ninth Circuit Court of Appeals decision against Omnitrition. A class action suit was filed (by two disgruntled ex-distributors) and the suit was originally dismissed in Omnitrition’s favor by summery judgment (it didn’t even go to trial). When the class appealed this decision, the Ninth Circuit Court not only ruled in favor of the class action (demanding only that the lower court must hear the case), the court uncharacteristically offered a detailed opinion as to why. The court proclaimed that personal purchases were not applicable in satisfying the 70% Rule and therefore there was a legitimate case to be made that, in fact, Omnitrition was operating an illegal pyramid (again, this decision only required the lower court to go forward with the case and did not actually declare Omnitrition a pyramid scheme). The outcome of the lower court trial is still pending.

Having spoken with numerous individuals within the offices of Attorney’s General (yes, that is the proper pronunciation) throughout the country over the years, I had ample opportunity to quiz them as to their position on this “or consumed” issue. Only onestate, Michigan, offered the clear and specific opinion that “personal consumption does not satisfy the 70% rule in this state.” Ironically, this is the home state of Amway itself which has evolved into the epitome of transfer buying and personal consumption within this industry. (And, again, without incident or harm to anyone). In fact, Amway recently went counter to the regulatory trend and reducedtheir ten customer requirement to five customers! And, in spite of this verbal declaration given to me over the phone, I can find no specific action taken by the Michigan AG’s office in which they’ve challenged the personal consumption aspect.

Most recently, California and North Carolina have boldly and clearly declared that personal consumption does not (no longer?) satisfy the 70% Rule and that no commissions or bonuses can be paid to distributors on personally consumed product. One recent case involves Destiny Telecom and the state of North Carolina. This case is especially disturbing in that the state not only demanded that Destiny verify to the state, on a monthly basis, that 70% of all wholesale orders by distributors are being retailed to non-distributors, but further demanded the following: “Should a North Carolina retail customer subsequently establish such a connection by becoming an ‘Independent Representative’… any prior salesmade to that customer shall be considered an internal sale from the time of sale and shall not be considered a retail sale for any purpose at any time” (underline emphasis mine). Understand, this startling and bizarre provision is declaring that, for example, if you are strictly a retail customer for an entire year, then you decide to simply sign a distributor application, even if it’s just so you can get the products at wholesale and you have no intentions of working the business, Destiny will not be able to count, nor will North Carolina accept, the entire previous year’s worth of sales as retail sales!There is no legal, ethical, or logical explanation for such a demand to be made on a network marketing company.

But there’s more.

Immediately following the above statement (found on pages two and three of the Consent Agreement between Destiny and NC), the agreement goes on to demand that “Destiny shall immediately revise its records to ensure that the benefits provided to all relevant participants are adjusted accordingly.” In other words, all the commissions and bonuses that were previously paid on this year’s worth of retail volume (based on the above example) must be deducted from those distributors next check! Amazing.

California’s AG’s office, within their Final Judgment against Destiny, has ruled that any type of sales aid or live training is not commissionable. Curiously, Destiny never paid commissions on either of these items — but several major competing companies do! While the judgment was somewhat ambiguous as to the personal consumption issue, nothing was left to the imagination in the consent decree issued by California against AuQuest. Herein they ruled that commissions may only be paid on sales to the “ultimate consumer.” However, they went on to define “ultimate consumer” as “Persons who are not a part of the AuQuest Marketing Plan.”

At first glance the state of Arizona, in their consent decree with TeleSales, Inc. (another prepaid phone card deal) seems to have used a little common sense in the matter. They ordered that commissions must be based on “retail sales,” but defined this as being sales to persons who “are not part of (the) marketing program” but also sales to “persons who, although desirous of becoming or who are part of (the) marketing plan or distribution system, are buying for their own personal or family use.” There is a subtle nuance in this definition that may have been missed. Arizonadid not say that a distributor’s own personal consumption is commissionable to his or her upline, but rather a “sale to” anotherdistributor for their personal consumption! This, of course, begs the question, Why would a distributor buy at retail from another distributor when they can buy at wholesale direct from the company via their own distributorship? (Arizona also fined several of what TSI reported to them to be “major” distributors $25,000 each, which begs the question, What is a “major” distributor? Exactly how big does someone’s downline have to be before they stop becoming the victim and become the perpetrator? Five hundred? Five thousand? What!?).

What these rulings requiring commissions be paid only on retail sales to non-distributors does, in effect, is place the selling distributor in a very precarious position from an ethical standpoint. They would now be motivated to hide the fact from their customer that they can simply sign up as a distributor, likely at no charge, and get the product significantly cheaper. When the retail customer inevitably discovers this option, they surely will question the selling distributor as to why this option was never presented to them. They’ll probably be at least a little POed — and rightfully so. To place a distributor in this position is the real crime here!

These regulatory people’s job is to prevent us all from getting hurt. Isn’t creating a strong motivation to keep retail customers out of the distributor scrolls, thus causing them to pay 30-40% more than they need to be paying for their products, harming that customer?

What’s more, it can cause harm to the distributor as well. Think about it. Who, in the 53 year history of network marketing, has ever been harmed by purchasing only the amount of product that they can comfortably consume themselves? No one! Who has been harmed by buying more than they can consume, or even sell? Thousands! What the 70% rule effectively does, when personal consumption is not factored in, is require by law that the distributor purchase over three times as much product as they can personally consume! If Mary only wants to purchase $100 worth of products for herself and her family, the 70% rule (sans personal consumption) requires that she purchase $333 worth of product — then be forced to sell the extra $230 worth within 30 days, or be forced to lie about it just so she can get the products she wants the next month (typically, companies are not suppose to let you order more products unless you’ve met the 70% rule).

Not only that, but if Mary does only order $100 worth, this screwy interpretation of the 70% rule would require that she sell $70 of it, leaving her with only $30 for herself. So, she must then order another $70 in product to get the $100 worth that she truly desires. But wait! Now Mary has purchased $170 in product total. She needs to retail $119 of it to satisfy the personal consumption-less 70% rule. So she retails another $49 to satisfy the rule — leaving her $21 short of the $100 worth that she really wants for herself. So, she orders another $21 from the company. But, alas, she’s now ordered a total of $191, and $14.70 more product must be retailed.

Isn’t this just a little ridiculous?

In an effort to make our industry less financially risky, thus lessvulnerable to media and regulatory attack, most MLM companies have enacted a free sign up system where even the “at cost” distributor kit is an optional purchase. But, by doing so we’ve now totally blurred the lines between “customer” and “distributor.” It makes no sense for someone to be paying retail prices for something they can get at wholesale by simply calling an 800-number and “signing up.” So, now retail customers all appear to be “distributors” in the company’s database. Our efforts to make ourselves less vulnerable has made us more vulnerable! What’s more, the absurd way in which some regulators have defined the law in this situation actually puts us and our customers back into a situation of spending significantly more money than we were originally requiring. All in an effort to protect us!

The true spirit of the 70% rule was to simply eliminate front loading and stock piling. In years past it was routine to find many people “buying into” a certain position in the compensation plan with an up front several thousand dollar purchase. This is where the term “garage qualified” came from. And to keep qualified for that position, they’d order hundreds or thousands more each month. These purchases were not because they wanted the product or had the retail client base to sell it to, but rather it was simply a token act to keep qualified in the plan. The 70% rule was designed to eliminate this practice. Well, by counting personal consumption towards the 70% rule it still effectively accomplishes this! And, once again, by not counting personal consumption the distributor/consumer is force by law to actually purchase more products than they wish to!

Arguably, companies like Destiny, AuQuest and TSI were worthy targets due to the lack of any significant amount of retailing and the great emphasis placed by their distributors on recruiting and “buying into” a higher pay level in the plan. Other recent targets, such as Fortuna Alliance, Gold Unlimited, and Boston Finney, also demonstrate that regulators are picking their spots. Very likely noMLM company is truly retailing 70% of their sales volume to non-distributors. Yet the Amways, Shaklees, and Herbalifes continue to do business, unchallenged, in even the most MLM-unfriendly states. As it should be.

On an even more positive note, three states, Texas, Oklahoma, and Louisiana, have recently passed model legislation that specifically declares personal consumption as a valid sale and applicable to the 70% rule. Several other states will be considering similar legislation in 1999 as well.

The greatest fear we should have is that, someday, there is federal regulation of the network marketing industry — and theydemonstrate the same utter lack of understanding of how this business works and what’s best for it’s participants. On a case-by-case, state-by-state basis, we can survive and even thrive. But if Big Brother ever decides to cop the same attitude as a few state AG’s, well, better thank you lucky stars for the Amways, Shaklees and Herbalifes.

Personally, I’m hoping for federal regulation. And I hope that it will be based on the precedent set in the FTC case against Amway back in 1979 and require all companies provide full disclosure and allow for personal consumption to apply towards the 70% rule.

Let us hope.

The Tax People: A Case Study

By Len Clements © 2000

The numerous state and federal actions against this company is now old news. Every MLM “watchdog” has reported on it as well as several news sources. I believe that what, where and when these actions were, and are being taken is certainly important, but most importantly is why. Since The Tax People, aka TTP, aka AIM, aka Advantage International Marketing, aka Renaissance, has been under investigation for both alleged securities and pyramid violations by a number of state and federal agencies, I believe it makes for an excellent case study. Here, in chronological order, is a history of TTP and it’s founder and President Michael Cooper, including commentary and a final analysis.

1984: Michael Cooper discovers network marketing. He has initial success as a distributor only to see the company fail.

1989: Cooper is the Executive VP and founder of National Energy Specialists Association.

1991: Cooper is the National Director of Training for American Gold Eagle, a gold coin MLM, and one of the early pioneers of the binary compensation plan. AGE is eventually shut down for securities and pyramid violations (they claimed the Gold Eagle coins were a great “investment”). The pyramid label was due mainly to AGE reps buying product solely to acquire additional income positions in the compensation plan (the emphasis was on recruitment, not actual sales of the products – keep that in mind for later).

[Comment: The founders of AGE, David and Martha Crowe, will go on to found Gold Unlimited (without Cooper), which will also be shut down with 11 criminal counts against David and 10 against Martha. The Crowes fled prosecution and were recently featured on the TV show America’s Most Wanted].

1992: Cooper is the founder and President of Network Institute, also a binary, which deals primarily with productivity tools. The main product is the Management Action Planner (called MAP), an elaborate, leather bound time management and productivity system. The MAP sells for $295. There is a monthly $30 charge that includes supplies for the MAP, access to a phone training system called “One Minute Manager” and a tax deduction tracking system called Tax Tracker.

1993: Cooper sells Network Institute to his partner and takes the position of Executive Vice President of a start up long distance reseller called TeleFriend (which used a unilevel comp plan). Soon after, Network Institute is merged into TeleFriend as a distributor support system. Later this same year Cooper leaves TeleFriend on unfriendly terms.

1994: Cooper assumes the position as President of a small network marketing company called Truly Special (TRI). TRI sold specialty foods manufactured by it’s parent company Briarwood Farms.

November, 1994: Cooper and other senior personnel of TRI begin holding meetings where potential incomes of $100,000 are touted with an initial “investment” of $100. Also, shares of common stock in a company called Aunt Myra’s (AMI), a non-MLM marketer of ground beef seasoning, is offered for sale to participants in TRI. During this time Cooper also conducts live, national opportunity calls.

[Comment: On one such call, which I was listening in on, Cooper questions the reasoning behind distributor requests for him to focus more on the value of the products. He responds, “If I told you you could make $10,000 a month selling horse manure, would you care what the product was!?”]

December, 1994: Truly Special, Cooper, and other senior management are hit with an “Emergency Cease and Desist” order by the Securities Division of the Kansas Attorney General’s office for selling unregistered securities without a license. Aunt Myra’s is not a public company and it’s stock can not be legally sold. Furthermore, there are charges that TRI itself is an illegally sold security based on the $100 “investment,” and the heavy emphasis placed on recruiting others to invest, rather than product sales. The state’s charges also include various full-disclosure violations, such as; they failed to disclose to investors that in 1987 Aunt Myra’s was hit with a Cease & Desist order for having violated various provisions of the Kansas securities laws, and in 1989 AMI’s President and Chairman Gary Kershner was found guilty of two felony counts of selling unregistered securities.

Early 1995: TRI and Cooper are again under investigation by the KS AG’s office. This time the focus is on pyramid violations rather than securities violations. Once again, the catalyst to the investigation is the heavy emphasis on recruitment rather than product sales. Within weeks, Cooper closes down the company.

June, 1995: Cooper launches Renaissance Designer Gallery, a marketer of high ticket goods such as jewelry, art, collectables, and gourmet food. He is the majority shareholder, owning 64.04% of it’s common stock.

April, 1996: Cooper signs a posthumous Consent Judgment pursuant to the KS AG’s investigation of Truly Special. He agrees to be “permanently enjoined from engaging in those acts and practices alleged to be deceptive or unconscionable… (and) agree that engaging in such acts or similar acts, after the date of this Consent Judgment, shall constitute a violation of this order.”

[Comment: Cooper also agrees, and is now legally obligated, to disclose the existent and provisions of the Judgment to all of his (not Truly Special’s) future employees, agents and representatives for the next two years. Allegedly, he has not done so.]

November, 1997: Advantage International Marketing (AIM) is formed as a division of Renaissance to market tax related products and services. By the end of 1997 AIM has 489 distributors. AIM would eventually be known as The Tax People.

March, 1998: Renaissance purportedly has 20,933 distributors. AIM now has 1,648.

May, 1998: During a special interactive teleconference call several hundred AIM reps are introduced to “Commitment 2000.” Cooper himself describes how all AIM reps who will commit, in writing, to simply remaining active in the company until January, 2000 will receive 1,000 shares of stock in the company “regardless of whether they ever make a sale.” He further explains that an additional 1,000 shares of stock will be issued for every sale (of the $300 Tax Advantage System) that is made. In addition, he claims 1,000 shares of this stock is “worth today over $40,000.” He concludes by cautioning against promoting or advertising the deal by means other than private invitations. He refers to the information related on the call as “double secret stuff” and further comments “There are no misdemeanors in securities violations.”

June, 1998: Cooper files form SB-2 with the SEC in preparation to register common stock in Renaissance for the purpose of sale and distribution to distributors per the “Commitment 2000” announcement made in May.

August, 1998: Cooper applies to the SEC for withdrawal of their Registration Statement citing their inability to secure a broker/dealer required for registration purposes in several states.

September, 1998: Cooper is again sanctioned by the Securities Division of the Kansas AG’s office. Again it’s for offering unregistered securities (stock in his company, which was not yet registered) and for “omissions and misrepresentations” concerning the offer. For example, disclosure documents filed by the company revealed that the tangible book value of the stock was less than 0.005 cents per share – not $40 per share as was announced on the “Commitment 2000” call. The proposed offer price was 10 cents per share. Plus, distributors were never told during the call that not only was the stock not registered, there had not yet even been any action taken to register it. Cooper is forced to rescind the “Challenge 2000” offer to the 1,196 who signed up for it.

[Comment: It should be noted here that based on the definition of a security (SEC vs. W. J. Howey Co., 1946) the “investment” made in exchange for stock need only be “consideration.” That being; money, gold dust, chickens, labor – anything of value. Indeed, the SEC has even defined a “promise” as being “consideration.”]

October, 1998: The Kansas Attorney General’s office appoints a Special Agent to begin a formal investigation into the business practices of TTP.

May, 1999: Dan Gleason, President of My Tax Man, resigns from the Board of Directors of AIM/TTP citing a difference in product philosophy. My Tax Man is the company hired to fulfill the monthly tax services supplied by AIM/TTP, such as audit protection, 1040 preparation and review, telephone consultation, etc.

June, 1999: My Tax Man sends a “Termination of Service” to Cooper announcing they will no longer be providing the ongoing monthly services.

[Comments: This may well be one of those “you can’t quit ’cause you’re fired” deals. Gleason claims there was a falling out between him and Cooper resulting in a demise of contract negotiations, so he terminated the agreement. Cooper claims he terminated the services of My Tax Man which may explain why no further contract negotiations were offered by TTP. We’ll likely never know who really terminated who first. However, Gleason did initiate his company’s separation from TTP.]

July, 1999: TTP comes under investigation by the Securities Enforcement Division of the Attorney General’s office of Hawaii for possible pyramid and securities violations.

Summer, 1999: The Missouri AG’s office begins an investigation of TTP.

August, 1999: My Tax Man is issued a subpoena by the KS Attorney General’s office demanding the TTP member database. That same month Dan Gleason is deposed by the KS AG’s investigating attorney. An agent from the Criminal Division of the IRS is present for the deposition.

August, 1999: Sandy Botkin, founder of the Tax Reduction Institute and author of TTP’s “Tax Relief System” officially parts ways with TTP, demanding that TTP discontinue use of of his products, name and likeness.

[Comment: Botkin claims he verbally requested that TTP stop using his name and material as early as May. The Tax Relief System was the up front $300 product purchased by new TTP reps which activated their position in the compensation plan.]

January, 2000: Sandy Botkin sues TTP for continuing to use his name, and for using promotional material that suggested they were still using his tax education package as their Tax Relief System.

[Comment: Several months after I had first heard that Botkin had completely disassociated himself with TTP I received in the mail, unsolicited, an audio tape featuring an interview between Michael Cooper and Sandy Botkin praising the benefits of Botkin’s “Tax Relief System.” I discovered that, in fact, the tape was still a TTP supplied sales aid even though the product being sold by TTP was no longer Botkin’s.]

April, 2000: Cooper and TTP are the subject of a moderately negative article in The Kansas City Star newspaper

[Comments: Within the article Cooper responds to questions concerning his involvement with Truly Special by saying he took the president position weeks before the legal complaint was filed and was unaware of the company’s legal problems. However, within that complaint it is stated, “Defendant Cooper is an individual who was President of Truly Special, Inc. during the time the acts alleged in paragraph eight occurred.” It further states, in paragraph eight, that “…the following acts and practices by Defendants Cooper and (codefendant) were deceptive and/or unconscionable and violate the Kansas Consumer Protection Act…”. Cooper’s signature appears at the end of the Judgment.]

April, 2000: The Criminal Division of the IRS demands the latest TTP member database from My Tax Man, which they supply.

May, 2000: W. Bradford Murray sues TTP in Federal court for copyright infringement claiming much of the tax advise in the new Tax Relief System was taken verbatim from his work. The company claims it acquired the rights legally through an intermediary.

May, 2000: The KS AG’s office reports 27 formal complaints have been filed against Renaissance, AIM and TTP dating back to 1995. Fourteen are still open (unresolved).

[Comments: The TTP spin from the field was that this was par for the MLM course. Not true. This is, relatively speaking, a substantially high number of complaints for a five year old company.]

June, 2000: In an internal IRS newsletter within an article titled “Tax Alchemy” they warn, “In a multilevel marketing scheme, unsuspecting investors may be told they can convert their personal expenses into home business deductions by selling the tax shelter program to their friends.” This is the first public hint that there is an IRS investigation of TTP.

July, 2000: TTP now claims to have over 50,000 representatives.

August, 2000: The North Carolina Attorney General advises Cooper that TTP is an illegal pyramid and they should stop soliciting NC residents.

September, 2000: Cooper and TTP are the subject of a harsher, although not entirely negative article in the New York Times. The article is primarily critical of the tax strategies taught by TTP.

September, 2000: TTP is the subject of discussion during a segment of The O’Rielly Factor, a Fox News television program. An ex-IRS commissioner is also part of the on-air discussion. The lone TTP representative (not Cooper) spends most of the ten minute segment deflecting accusations of pyramiding and defending their tax strategies.

[Comment: The segment ended on it’s only positive note with the host suggesting TTP’s $40 per month fee for audit protection “sounds like a good deal.” However, Mr. O’Rielly apparently didn’t have a calculator handy. More on this in the final commentary.]

October, 2000: The North Dakota securities commissioner issues a cease and desist order to halt “recent” offers of stock in Renaissance/TTP to at least one NC resident as an incentive to keep them participating.

[Comment: Unbelievable.]

October, 2000: The TTP home office is raided by the Criminal Division of the IRS as well as the US Postal Inspection Service.

October, 2000: The Kansas AG’s office receives inquiries about it’s investigation of TTP by 8 other states, including California and Florida, as well as from the SEC and FTC.

October, 2000: TTP agrees to a Temporary Restraining Order (TRO) requiring them to shut down their web site, halt all new sales and enrollment of new reps, and discontinue the paying of commissions and bonuses. The company’s assets are frozen, although the order does allow for the ongoing fulfillment of various services, such as audit protection and tax advice, and the payment of basic operating expenses.

[Comment: This is a state action and it separate from the federal investigations.]

December 11th, 2000: A hearing will take place to decide the resolution to the TRO. Either it will be lifted, modified, or the company will be permanently enjoined from doing further business.

In the KS AG’s Petition to the court (to be decided upon December 11th), there are several key statements. A listing and analysis of each follows:

1. “Defendants (TTP/Cooper) are responsible for the acts and omissions of their employees and agents under the legal doctrine of respondeat superior and agency.”

[Comment: Much of the spin coming from the field is that TTP was clean, but the actions of a few renegade distributors was the cause of the legal actions. The same case was made by Equinox. It didn’t work.]

2. “questionable use of home business deductions”

[Comments: Cooper and field leadership claim all the tax strategies taught by TTP are perfectly legal, thus there’s nothing to worry about. While the strategies themselves may be sound – although in some cases even that idea is being debated – it’s the manner in which they were implemented that is the challenge. Yes, it is legal to deduct a business trip even if you have some fun while you’re there – but the trip has to be primarily for business purposes. You can’t take a vacation to Hawaii, stick a few business cards on windshields and call it a business trip. Yes, it is legal to hire your children and deduct what you pay them, but they actually have to work in your business, and you have to set up a real payroll system – preparing W-4 forms, filing quarterly 941 forms, issuing W-2, etc. Yes, it is legal to deduct a portion of your home used for business – but it has to be (among numerous other limitations) an area used 100% as your primary place of business – so your kitchen table doesn’t count.

So, again, the legal challenges to the TTP strategies are not so much to do with the strategies themselves, but the questionable manner which they are being promoted and used. Remember, the IRS isn’t assuming anything. They don’t have to guess. They’ve had over a year to analyze the TTP teachings and to review the tax returns of TTP members and reps before they took action. The KS AG has had over two years. Obviously, they didn’t like what they saw.]

3. “Defendants are in the business of selling tax deductions.”

[Comments: The primary reason for starting a business must be to make a profit, not create tax deductions. If you don’t show a profit motive the business may be declared a “hobby” by the IRS thus related expenses would not be deductible. Based on everything I’ve seen and heard from TTP and it’s reps, the emphasis clearly seems to be on the tax savings you’d receive by becoming a TTP rep. In fact, a common practice among some TTP reps was to tell prospective buyers to lower their withholding for taxes even before they joined to cover the up front cost for the systems.]

4. “In essence, Defendants are selling a home based business to participants that consists of nothing more that selling the same business to other participants so that they too can take the aggressive business tax deductions promoted by Defendant’s scheme.”

[Comments: This point reminds me of those manuals on how to get rich in mail order by selling manuals on how to get rich in mail order. Essentially, the Kansas AG is saying there is really no business here, other than the business of selling the business.]

5. “The following false claims are contained in one of three of Defendant’s video tape promotions:

(a) ‘This program is approved for 8 hours of continuing professional education…’

(b) ‘Renaissance is a publicly traded company.'”

[Comment: Although Cooper did take steps to have each of these statements eventually come true, neither was at the the time the videos were produced, nor are they now.]

6. “Defendants have engaged in unconscionable acts or practices in connection with consumer transactions while knowing or having reason to know that when the consumer transactions were entered into the price of Defendant’s services grossly exceeded the price at which similar services were readily available…”

[Comments: You can’t mark up a product just to support commissions in an MLM comp plan. Indeed, there are other, non-MLM, tax services that offer almost identical services as TTP for less than half the price. The concern here is that most TTP reps were not purchasing the monthly service just for the value of the service, but to also meet the qualifications in the comp plan. In other words, they likely would not have paid $100 per month for those services if there were no income opportunity.

Is the $40 per month for audit protection a “good deal?” Well, considering the average American is 35 and the average age of death is around 75, and according to the IRS the average number of times someone is audited is once every 120 years (0.8% per year) that would mean the average TTP member would pay $19,200 in their lifetime to protect themselves from the 1 in 3 chance of being audited at least once. Of course, you could not pay the $19,200 to TTP and instead pay the best tax attorney in the country to represent you IF you are audited and still save several thousand dollars.]

7. “Defendants adopted, implemented and enforced a distribution system whereby Defendants paid commissions, bonuses and other benefits to participants who purchased ‘Founders Paks’ that were not based on the sale of bona fide products to verified end-user consumers.”

[Comments: The KS AG put this point more succinctly when she stated, “I believe it is illogical for people to buy four or more tax relief systems unless it is to expand the pyramid.” This is the crux of the pyramid accusation. Basically, MLM companies can only pay commissions on products that would realistically be purchased based on the value of the product alone. In other words, if it’s sales volume that would only be generated by enrolling a new rep, then it would be income based primarily on recruitment which is the epitome of what defines an illegal pyramid. I have asked a total of nine TTP reps what the value was to purchasing a Founder’s Pak (four Tax Relief Systems for $1,200 total) and nine out of nine responded by telling me how it would activate more income earning positions, thus I could earn more money. In one case I explained why this was a bad answer and the distributor responded by claiming I would also need extra systems for demos. Well, that would then make them sales aids and still non-commissionable (because only reps would purchase sales aids). He then decided to take a life-line and call a friend, a “top distributor” in TTP. His response was that a new rep needed extra kits so as to have “revolving inventory.” However, when a system is sold and the paperwork is sent to the company, TTP automatically drop ships a Tax Relief System. “Yes,” was the response, “so your customer now has two kits and they give one back to you to replace in your inventory.” Okay, so why tie up $900 of my family’s budget (for the extra 3 kits besides my own) in inventory I may or may not sell, when the company will drop ship on an as-needed basis? Besides that, TTP’s own marketing material promoted buying four systems to get “double the pay out.” Clearly, the first answer was the right answer, no matter how wrong it was.

What is curiously missing from any legal argument against TTP is the fact that each of the four positions that are activated with a Founder’s Pak purchase would eventually require a $100 per month purchase to keep each of them fully qualified. That would be $400 per month (which, as it was described to me, would happen automatically once your income was sufficient to cover this cost). There seems to be no doubt that this would be a token purchase just to meet a quota and not for the value of what’s received.]

8. The Petition asks the court, among various other proposed penalties, “that Defendants be permanently enjoined from engaging in any form of business involving multilevel marketing or referral sales.”

Final Analysis and Commentary

I’ve spoken with many TTP reps over the years. I’ve spoken at one of their events here in Las Vegas and met with many of them personally. I found them to be sincere, honest folks who genuinely believed in what they were doing. Today, when I listen in on their conference calls and read their on-line messages my heart aches. It looks as if most of the leadership is staying loyal based on company propaganda that suggests the TRO will be lifted, TTP will be vindicated, and it will soon be business as usual. Also, that the federal raid was initiated by competitor lies, and all the actions would be dropped once the authorities discover how TTP really operates.

Reps are also being told that many other successful companies, such as Herbalife, Nu Skin and Amway, have gone through equally challenging times and survived. Herbalife did $430 million in the U.S. in 1983. They did $30 million in ’84. TTP did $24 million last year, before the legal action. I know Herbalife, and TTP is no Herbalife. What also wasn’t woven into the spin is the fact that each of those companies were financially devastated in the U.S. by the legal actions against them and very likely survived due to revenue from foreign markets – a deep well TTP doesn’t have access to.

Reps are also being encouraged to keep paying their $40 per month for audit protection because now, with the IRS scrutinizing their returns, they need this service more than ever! However, Cooper has openly stated that if the IRS were to audit too many client returns the company may not have the resources to fulfill its audit protection promise. What’s more, if someone has paid the $40 fee for the last few years then stops, and a past TTP prepared tax return is then audited, TTP will not represent them (typically, audits begin at least 18 months after a return is filed). You have to keep paying the $40 now to protect past returns.

Unlike what’s coming out of the TTP spin cycle, these actions are not due to “misunderstandings” perpetrated by TTP “enemies.” The IRS criminal investigation is clearly due to what they saw, not hearsay testimony by vindictive ex-experts. The raid is actually the end-stage of the investigation which, on a state level, have been on-going for over two years, and at least one year on a federal level. Understand, a search warrant can’t be obtained without strong “probable cause.” A federal raid can not be authorized without the authorities believing they already have a very strong case. A TRO could not be initiated without a judge reviewing the evidence and agreeing there is a strong case. And remember, the TRO is a state action. Even if it is lifted, there is still not one, but two separate federal investigations (IRS and U.S. Postal Service) to contend with, not to mention the various other states that have taken, or will take, action against them. There appears to be a conga-line forming.

There are three possible outcomes to the eventual ruling on the AG’s petition:

1. The company is permanently enjoined from doing business. That is, they’re gone. It’s over. This is what the AG is asking the court to do. If such action is taken it would not be unusual to also see Michael Cooper banned for life from further participation, in any capacity, in MLM. This was the penalty imposed on two of the founders of FutureNet, as well as Equinox founder Bill Gouldd. The most horrific aspect of this possible outcome is that, if TTP is formally and finally declared an illegal pyramid, all of the previous deductions taken by TTP reps may no longer be deductible.

2. TTP will be required to completely overhaul the program, which would likely include a significant price decrease, the complete elimination of Founder’s Paks (or of qualifying multiple income centers), the elimination of TTP itself as “the business” which deductions can be taken, and a provision that no purchase volume is commissionable unless there is a certain amount of verified retail sales to non-distributors (it was 50% in the Jewelway case). There could also be a court mandated refund to any current or past reps who want their money back. In other words, TTP is allowed back in business and then quickly dies a natural death by attrition.

3. The TRO is modified or remains the same and TTP fights it out in court – and to the victor go the spoils. With no end in sight to the moratorium on paying commission, reps would leave in droves. It would be business suicide.

One would think that the chances of outcome #3 happening is slim to none. But then, Michael Cooper, who is a member of Mensa (the high IQ society), seems to have an SQ (Stubbornness Quotient) even higher. I was specifically told by a representative of the KS AG’s office that their investigation was initiated due to the number of complaints being filed, almost all of which due to dishonored refund requests (which allegedly came after the 30 day window to receive refunds). The AG’s office claims refund requests were “shuffled around” to force them beyond the 30 day window. TTP denies this. Regardless, at last count there were 27 complaints. If you could have happily and swiftly refunded $300 to 27 people and avoided a state Attorney General investigation (and potential destruction of your company), wouldn’t you have just paid the refunds?

This could be the most costly $8,100 an MLM company ever saved.

Epilogue

On December 12th there were three separate live conference calls to announce the results of a settlement that had allegedly been reached with the Attorney General of Kansas. Each call was conducting by a leading distributor who informed the well over 1,000 listeners that a settlement was in fact eminent, but the details could not be announced until the “documents are filed,” which would be at any time. By the third and final call of the day the announcement was made that the details of the settlement still could not be discussed while “they cross the ‘I’s and dot the ‘t’s” (exact quote) and that the details would be announce on Sunday, the 17th. As it turns out, there was no settlement.

On December 17th Michael Cooper addressed the settlement issue on a live, national conference call. He claims the Kansas AG had proposed a settlement offer requiring TTP pay a one million dollar fine, admit guilt, and make one simple change to their plan. Allegedly, that change involved nothing more than charging a distributor the “wholesale” cost on all purchases of the Tax Advantage System after the first purchase. He claimed “everything else was fine.” The settlement also required that Cooper must step down as CEO. However, he further stated that on Monday (the day the settlement was to be announced), after agreeing on the settlement terms, the AG added several more “hoops” to the settlement. Cooper then claims to have had a discussion with other TTP leadership and, as a group, decided to forgo the settlement and await their day in court. That has been rescheduled for February 12th. In the mean time TTP can’t pay commission checks and reps may not sell or recruit.

Of course, all this begs the question, if the only thing the AG found wrong was charging full price for extra TAS kits, why the requirement to admit guilt to being a pyramid scheme, pay a million dollar fine, and banish Cooper?

Will there be a settlement before 2/12? Unlikely. That bridge seems to be burned to a cinder. On the national call, Cooper angrily made several incendiary comments regarding the Attorney General such as, “we got jerked around,” and that his “mistake was trusting and believing when I’m told we have a deal we have a deal.” He also stated that “God’s on our side” and that they were “on the brink of one of the greatest tragedies in corporate American history.”

It get’s worse.

On December 8th federal prosecutors moved to have TTP forfeit $8.9 million that was seized from 13 separate accounts associated with CEO Michael Cooper and TTP/Renaissance. The funds were seized as part of the raid conducting by the IRS and US Postal Inspectors Office. The U.S. attorney for Kansas filed a civil law suit claiming TTP has been involved in mail fraud and money laundering. Remember, this is a totally separate action from the settlement negotiations with the state Attorney General’s office.

The complaint filed by the U.S. Attorney divulged even more scathing evidence of fraud and deception by TTP and Cooper. Details of conversations between TTP corporate personnel, including Cooper, and undercover agents are described, as well as allegations of fraud pertaining to Cooper’s personal history. In one case, Cooper is videotaped while making the claim “I overpaid my taxes by $4,000 per year for the past 15 years.” However, based on IRS records there were seven years since 1985 in which Cooper’s total tax liability was less than $3,000, including two years (1991 and 1995) in which his tax liability was ZERO. In an audio tape produced by Cooper he made the statement, in regard to his involvement with Truly Special (his previous company before Renaissance) that he was “personally earning $20,000 per month and resigned as President and walked out on over $40,000 per month personal income.” According to Cooper’s 1995 income tax return, he reported no wages and a $52,545 loss from a sole proprietorship business venture. In yet another example, Cooper says on his recording, “I haven’t borrowed any money since 1982, don’t have a mortgage or payments on our home and we pay cash for whatever we want or need.” In fact, Cooper has filed three separate Chapter 13 bankruptcies since 1982, the last of which, in 1993, involved 39 separate creditors and debt totaling $167,000.

The entire 26 page complaint, along with several other legal filings, can be found at www.cjonline.com.

Could there be a settlement with the Feds? Again, not likely. Cooper addressed the federal action during the live call by assuring listeners he would fight to prevent the feds from “stealing your commissions.” He referred to the government’s pursuit of TTP as an act of “tyranny.”

Final Commentary

After listening to Cooper’s “Independence Day” style speech, it seems as if he genuinely believes neither he, nor TTP, has done anything wrong. What he fails to acknowledge is the fact that reps, and TTP literature, did routinely promote $1,200 Founder’s Packs as a way to qualify for more income, Cooper did make numerous false comments, the products were overpriced, reps did focus way too much on the tax savings rather than the profit motive (of starting a business) and they absolutely did apply the tax strategies in an overly aggressive manner. In fact, according to court documents, the IRS has audited many tax returns filed by TTP members over the past year that reported little gross sales and disproportionally high costs for automobile expenses, family wages, depreciation, travel and business use of the home. The federal lawsuit further states “During the civil review process, the IRS determined that many of these taxpayers were not legally entitled to claim these expenses, despite the fact that Renaissance promoters have claimed that these types of deductions are legal and appropriate… The majority of these audits have resulted in the disallowance of Renaissance-related business expenses and subsequent assessment of additional taxes and penalties.”

TTP is going to pay now, or they’re going to pay later. If Cooper really had his distributor’s best interests at heart, he’d take one for the team, pay the bill, admit guilt, step down, and let them get back to work.

The Tax People: Response & Rebuttal

By Len Clements © 2001

For those of you who are following the saga of Renaissance/The Tax People and have read my original expose’ (first published in November, 2000), you might also be aware of the alleged response by TTP CEO Michael Cooper. I say “alleged” because I do have doubts as to how much, if any, involvement Mr. Cooper actually had in constructing this response. Michael Cooper is a smart guy. These responses are not smart. I suspect they are actually the work of a TTP supporter who may have been working on behalf of Cooper. However, since Cooper has now had ample opportunity to disassociate himself from this response, I am going forward with this rebuttal assuming he at least has sanctioned it.

Let’s begin with the statement that introduces Cooper’s response: “CEO Mike Cooper’s point-by-point response of Len Clements widely read ‘case study’ of TheTaxPeople.net. Clements was apparently involved in several MLM organizations in the past with Mike.”

We’re off to a bad start. I was briefly involved as a distributor with a company operated by Cooper called Network Institute back in 1992. That’s it.

1984: Michael Cooper discovers network marketing. He has initial success as a distributor only to see the company fail. TRUE

1989: Cooper is the Executive VP and founder of National Energy Specialists Association (NESA). FALSE

ONLY PART-TRUE – NESA was incorporated as a not-for-profit trade association in 1984 with Mike Cooper as Executive Director, where he served until 1989. In 1989 and 1990, he was Executive Vice President of Eagle Shield, Inc., in Dallas — where he helped to build annual company sales to over $100 million a year.

REBUTTAL: Okay, he was the Executive “Director” of NEPA in 1989, not the Executive “VP.” Otherwise, the entire statement is not only TRUE, the response just confirmed it.

1991: Cooper is the National Director of Training for American Gold Eagle, a gold coin MLM, and one of the early pioneers of the binary compensation plan. AGE is eventually shut down for securities and pyramid violations (they claimed the Gold Eagle coins were a great “investment”). The pyramid label was due mainly to AGE reps buying product solely to acquire additional income positions in the compensation plan (the emphasis was on recruitment, not actual sales of the products — keep that in mind for later). [Comment: The founders of AGE, David and Martha Crowe, will go on to found Gold Unlimited (without Cooper), which will also be shut down with 11 criminal counts against David and 10 against Martha. The Crowe’s fled prosecution and were recently featured on the TV show “America’s Most Wanted”]. FALSE

ONLY PART-TRUE – Mike Cooper was only with them for only a few months, questioned their ethics and reported in writing irregularities of the business to the North Carolina Attorney General’s office — which lead to his being one of the “key” prosecution witnesses against the Crowe’s. When asked to testify against them, he paid his own airfare and hotel expenses to North Carolina — and refused reimbursement from the government.

REBUTTAL: Again, the response to the statement labeled as “FALSE” essentially confirms the statement. Note that all I said about Cooper was that he was the National Training Director for American Gold Eagle. I made no comment as to the duration of his tenure, his motivation for leaving, nor his post-participation actions. Every word of the events described concerning AGE are accurate (which Cooper does not deny). So, exactly what was “FALSE” in my original statement?

The point of this statement was not to question the ethics of Cooper, but to point out his close, first hand experience with what was deemed to be an illegal pyramid scheme. This experience should have made him acutely aware of what defines such a scheme. That being, the paying of commission on sales volume that is only produced by distributors (thus requiring recruitment to get paid). This experience should have made him acutely aware of the legal vulnerability of offering $1,200 “Founder’s Packs” and requiring $400 per month (for redundant monthly services) to qualify four business centers.

1992: Cooper is the founder and President of Network Institute, also a binary, which deals primarily with productivity tools. The main product is the Management Action Planner (called MAP), an elaborate, leather bound time management and productivity system. The MAP sells for $295. There is a monthly $30 charge that includes supplies for the MAP, access to a phone training system called “One Minute Manager” and a tax deduction tracking system called Tax Tracker. TRUE

1993: Cooper sells Network Institute to his partner and takes the position of Executive Vice President of a start up long distance reseller called TeleFriend (which used a unilevel comp plan). Soon after, Network Institute is merged into TeleFriend as a distributor support system. FALSE

ONLY PART-TRUE – Mike Cooper and John Meadows use the Institute training systems to build the largest and fastest growing downline in TeleFriend, which prompts the company to buy the company and move both of them to their home office in Tennessee, where Mike is made Executive Vice President.

REBUTTAL: So, everything I just said is TRUE, except that I claimed Cooper sold Network Institute to his partner before taking the corporate position with TeleFriend. Well, the only reason I made this claim is because that’s what Michael Cooper told me he did! I have a very clear memory of him saying to me, during a phone conversation, that he had sold the company to John Meadows.

1993: Later this same year Cooper leaves TeleFriend on unfriendly terms. 1994: Cooper assumes the position as President of a small network marketing company called Truly Special (TRI). TRI sold specialty foods manufactured by it’s parent company Briarwood Farms. FALSE

ONLY PART-TRUE – After a year long dispute with TeleFriend owners on behalf of his downline and all other distributors because the company is not providing the telephone service promised nor paying the distributors. The owners then share their plans to bankrupt TeleFriend and launch a new company to begin selling a $200 telephone debit card pyramid. Mike refused to participate, resigned, and took a computer consulting position with Truly Special in October, 1994. In December, he was named President of Truly Special just days before legal action is taken against the company for promoting the sale of their stock before Mike joined them. Mike never promoted the stock, and as the new President, immediately prohibited the promotion of the stock just days before legal action commenced. But as the new President, he was a company officer and was named in the action as well.

REBUTTAL: Here is perhaps the single most damning response. Either Michael Cooper is outright lying, or the author of this response is, in fact, NOT Michael Cooper (thus, the author who wrote this response is outright lying about the responses coming from Cooper).

First, note the three sentences in the original point. Once again, the response specifically confirms each sentence, word for word (yet, once again, the author labels the point as “FALSE”).

“In December, he was named President of Truly Special just days before legal action is taken against the company for promoting the sale of their stock before Mike joined them.” Now I get to say it… FALSE. I have in my possession a tape recording of two separate live presentations (one a conference call the other a meeting) given by Cooper in early November of 1994. Several times during the meeting he refers to “last Tuesday” as being “the very first day of the company.”

“Mike never promoted the stock, and as the new President, immediately prohibited the promotion of the stock just days before legal action commenced.” FALSE. During these recorded presentations he heavily promotes the stock sale. “We have a very simple monthly stock purchase plan. Any associate can participate if they wish, it’s $25.00 per month minimum.” He also states, “Most multilevel companies can’t even begin to be approved in all the regulatory manners that need to be to be on the stock market. Our company already is.” [Emphasis mine] Truly Special was not approved to be on the stock market, nor was it approved to sell stock.

November, 1994: Cooper and other senior personnel of TRI begin holding meetings where potential incomes of $100,000 are touted with an initial “investment” of $100. Also, shares of common stock in a company called Aunt Myra’s (AMI), a non-MLM marketer of ground beef seasoning, is offered for sale to participants in TRI. During this time Cooper also conducts live, national opportunity calls. [Comment: On one such call, which I was listening in on, Cooper questions the reasoning behind distributor requests for him to focus more on the value of the products. He responds, “If I told you you could make $10,000 a month selling horse manure, would you care what the product was?”] FALSE

ONLY PART-TRUE – Mike Cooper never promoted “investments” in any MLM. A gift box of gourmet foods, similar to a large basket from Hickory Farms was sold for $100. Mike Cooper NEVER used the “horse manure” example. He did use the “peanuts, popcorn, or pantyhose” example as a theoretical discussion of analyzing the profit potential of a business before starting one. Whether you like the idea of selling pantyhose, wouldn’t you like to have been the first to market “Peter Pan,” “Orville Reddenbacker,” or “Leggs” pantyhose? (whether you wear them or not)?

REBUTTAL: During these recorded presentations Cooper uses the terms “invest” and “investment” numerous times. At one point Cooper rhetorically asks the audience if they’d become involved if the “total business investment was $100 [to make] $100,000 per year?” And yes, he absolutely did use the “horse manure analogy (I was on the call and heard it with my own ears).

December, 1994: Truly Special, Cooper, and other senior management are hit with an “Emergency Cease and Desist” order by the Securities Division of the Kansas Attorney General’s office for selling unregistered securities without a license. Aunt Myra’s is not a public company and it’s stock cannot be legally sold. Furthermore, there are charges that TRI itself is an illegally sold security based on the $100 “investment,” and the heavy emphasis placed on recruiting others to invest, rather than product sales. The state’s charges also include various full-disclosure violations, such as; they failed to disclose to investors that in 1987 Aunt Myra’s was hit with a Cease & Desist order for having violated various provisions of the Kansas securities laws, and in 1989 AMI’s President and Chairman Gary Kershner was found guilty of two felony counts of selling unregistered securities. FALSE

ONLY PART-TRUE – Aunt Myra’s was, and to the best of our knowledge, is still a publicly traded company whose stock can be legally bought and sold (but not highly recommended at this time by anyone we know). It went from inactive at $0.02 to over $0.18 (900% increase in price) in less than 90 days with Mike Cooper as President, and back to inactive at about $0.02 or less in the months immediately following his resignation to start Renaissance.

REBUTTAL: I conducted several searches, including an EDGAR search at the SEC web site, and found no record of a public company called “Aunt Myra’s.” That doesn’t mean there wasn’t in 1994, so I’ll concede that is was a public company. But that has nothing to do with the point! (It’s a nice dodge, though). Whether it was public or not, neither Truly Special, nor their reps (or Cooper) were licensed to sell stock. That was the issue. Also, Cooper was not the president of Aunt Myra’s. Aunt Myra’s was the parent company of Briarwood Farms, and Truly Special was the marketing arm of Briarwood Farms.

Early 1995: TRI and Cooper are again under investigation by the KS AG’s office. This time the focus is on pyramid violations rather than securities violations. Once again, the catalyst to the investigation is the heavy emphasis on recruitment rather than product sales. Within weeks, Cooper closes down the company. FALSE

ONLY PART-TRUE – The securities action based on the stock option plan of the company, and the AG investigation of the MLM program were concurrent, and both resolved in short order with consent orders admitting none of the allegations, and no charges were pressed.

REBUTTAL: Reread the original statement declared “FALSE” and then try to find anything in the response that even begins to debunk the statement. So the two actions overlapped. So what? Where did I say they were not concurrent, and how does this disprove the statement? In fact, the consent order for the securities action was signed by Cooper in December of 1994 and the order regarding the pyramid action was signed in April of 1996. But why are we even wasting time on this one? It appears to be a desperate attempt to place “FALSE” after as many statements as possible.

June, 1995: Cooper launches Renaissance Designer Gallery, a marketer of high ticket goods such as jewelry, art, collectibles, and gourmet food. He is the majority shareholder, owning 64.04% of it’s common stock. FALSE

ONLY PART-TRUE – Renaissance was originally a marketer of some of the most highly DISCOUNTED priced goods in the jewelry, art and collectible fields. Renaissance expanded into additional product lines from Wrangler blue jeans to gourmet foods as we grew. Mike Cooper was the majority shareholder, owning 90% of the stock, the other 10% “gifted” to the two other principles in gratitude for their steadfast loyalty and hard work over several years they had worked with him through their painful experiences in TeleFriend, Network Institute, and Truly Special.

REBUTTAL: So, the only thing “FALSE” about the entire statement is the 64.04% figure (the response, once again, confirms the accuracy of the rest of the statement). Actually, it is true that he didn’t own 64.04% of the stock in June of 1995. He owned 64.04% of the common stock in September of 1998 when he was again accused of securities violations (we’ll get to that in a moment).

April, 1996: Cooper signs a posthumous Consent Judgment pursuant to the KS AG’s investigation of Truly Special. He agrees to be “permanently enjoined from engaging in those acts and practices alleged to be deceptive or unconscionable… (and) agree that engaging in such acts or similar acts, after the date of this Consent Judgment, shall constitute a violation of this order.” [Comment: Cooper also agrees, and is now legally obligated, to disclose the existent and provisions of the Judgment to all of his (not Truly Special’s) future employees, agents and representatives for the next two years. Allegedly, he has not done so.] FALSE

ONLY PART-TRUE – The consent order only required the company Truly Special and Mike Cooper to disclose to Truly Special employees, agents and representatives those provisions. As Mike Cooper was no longer affiliated with Truly Special, he had no control over what that company disclosed or not.

REBUTTAL: I’ve got a copy of the Consent Order. It clearly states that Cooper must disclose the Judgment to all of “his” future business associates. Furthermore, his failure to disclose this Judgment was cited in the 1998 securities action against Renaissance.

November, 1997: Advantage International Marketing (AIM) is formed as a division of Renaissance to market tax related products and services. By the end of 1997 AIM has 489 distributors. AIM would eventually be known as The Tax People. March, 1998: Renaissance purportedly has 20,933 distributors. AIM now has 1,648. May, 1998: During a special interactive teleconference call several hundred AIM reps are introduced to “Commitment 2000.” Cooper himself describes how all AIM reps who will commit, in writing, to simply remaining active in the company until January, 2000 will receive 1,000 shares of stock in the company “regardless of whether they ever make a sale.” He further explains that an additional 1,000 shares of stock will be issued for every sale (of the $300 Tax Advantage System) that is made. In addition, he claims 1,000 shares of this stock is “worth today over $40,000.” He concludes by cautioning against promoting or advertising the deal by means other than private invitations. He refers to the information related on the call as “double secret stuff” and further comments “There are no misdemeanors in securities violations.” FALSE

ONLY PART-TRUE – Based on what was believed to be competent legal advice, the C2000 stock was promised to IMAs at that time as a GIFT for believing and sticking with the company through the year 2000. It was “secret” only to the extent that they were warned not to make the stock part of the sales process as it was only for IMAs in the company prior to the upcoming annual convention, and no others. This call, which was recorded, specifically attached no value to the stock, but contemplates that it may or may not be valuable in the future, just as Prepaid stock went from 50¢ to as high as $40 per share.