|

Alert #227: 6/3/2014

Inside Wake Up Now

An Objective Review

By Len Clements © 2014

Disclosure: The time and expense involved with researching, analyzing and producing this review of Wake Up Now was funded, in part, by several competing network marketing companies. However, my reviews are never written to serve any other agenda than to portray the review subject in the most honest, accurate, objective and fairest manner. The companies which contributed funds towards the production of this review have been made fully aware of this, and I have been instructed to “call it like you see it.” And that is precisely what I shall do.

Disclaimer: The opinions, beliefs, observations and conclusions expressed in this review are solely my own and do not necessarily represent those of any other third party. I am not an attorney or regulatory agent of the government and thus cannot make definitive legal conclusions, nor should anything within this review be considered legal advice. All information within this review is based on research and analysis conducted between April 20 and May 27, 2014, with minimal participation by the subject, and is presented to the best of my knowledge at this time. I do not own, nor have I ever owned, stock in Wake Up Now and have no expectation of investing in Wake Up Now in the future.

INTRODUCTION

I’m prejudiced. I admit it. When ever I begin the review of any MLM company I tend to go into that process with some sort of pre-conceived idea of how the review will go. I pre-judge (the literal meaning of prejudice). Usually I anticipate the review being, to some degree, negative. Not because I’m cynical – oh, I am, but not because of that – but rather, most of my review subjects are by popular demand, and usually because the subject is controversial, or there is already a lot of suspicion about its ethics and/or legality, and people just want to know the truth, based on facts. That’s why I’ve most recently reviewed companies like Zeek Rewards1 and Empower Network2.

In the case of Wake Up Now (WUN), I confess to a high degree of ambivalence. On one hand I saw the very disproportionate amount of online rhetoric criticizing WUN and, at first blush, what appeared to be yet another “online mall” program (a category of MLM that has historically produced virtually a 100% failure rate). But on the other hand, I thought, imagine how much credibility I would gain by actually writing an overall positive review, in spite of the fact I was being paid, even in part3, by a group of competitors. I am by no means suggesting I ever intended to deliberately do so. I am as loathe to fudge the facts towards the positive as I am the negative. But I certainly intended to give them every benefit of the doubt, and allow them every opportunity to fully address any and all concerns I might have. So I admit it. I actually went into this review of Wake Up Now hoping it would be positive.

I don’t think I got my wish.

THE COMPANY

If you trace WUN’s genealogy back to its roots, you’ll find its great-great-great-great-grandfather was called Teaching Technology Corporation (March, 1967). TTC begat Stewart Morgan Corporation (Aug. 1980), which begat Axion System Science, Inc. (Jan. 1989) which begat Wordcraft Systems, Inc. (June, 1994). This is the WUN ancestor that was publicly traded, thus their current, and somewhat unfortunate, ticker symbol WORC (make the C soft, hard or silent and phonetically they just can’t win). Here’s where it gets a little tricky. Wordcraft Systems became a Delaware corporation called Wake Up Now in November of 2010, which was technically a shell. A few months earlier, in July of 2009, a new Utah corporation was created, also called Wake Up Now. Then, in December of 2010 the two WUNs mated (by reverse merger – ouch) and now Wake Up Now, Utah is a subsidiary of Wake Up Now, Delaware, which genetically now makes Wake Up Now, Utah a public company. Then, in April of 2010, Wake Up Now had a child and named it CurrentSee, Inc., which was conceived in Nevada.4

To be clear, I’m reviewing Wake Up Now, Inc., the Utahbased corporation.

WUN’s management team has completely changed over since its inception. Of the ten senior managers they listed online in September of 20105, seven were gone by the time current CEO Kirby Cochran came on board in August of 20116 and the changeover was completed by the end of 2013. As I understand it, the corporate overhaul was not entirely amicable.

Originally, WUN’s senior management was identified by titles such as “Crocodile Overseeing Vision“ (COV) and “Crocodile Steward of Growth” (CSG). I like it when MLM executives don’t take themselves too seriously and try to have a little fun. The croc theme was inspired by Crocodiles International, which describes itself as a “Personal and Organizational Culture Development Training and Coaching company.” More traditional titles were adopted around mid-2011.

The current management lineup has Kirby D. Cochran7 (60) at CEO, Jason M. Elrod8 (34) at President, and Phil J. Polich9 (65) at COO (presumably Chief Operating Officer, rather than Crocodile Overseeing Operations). All three gentlemen have substantial business experience, however, none of it appears to have been within the MLM space. They did wisely hire attorney Kevin Thompson and consultant Troy Dooly to assist in developing compliance policy, but not until late last year. They also hired the MLM law firm Grimes & Reese early on.

A background search of all WUN senior managers produced a few civil lawsuits10 and bankruptcies over the past 20 years, all related to other business ventures, but nothing at all unusual or troublesome, especially for those who were involved in real estate and venture capital.11

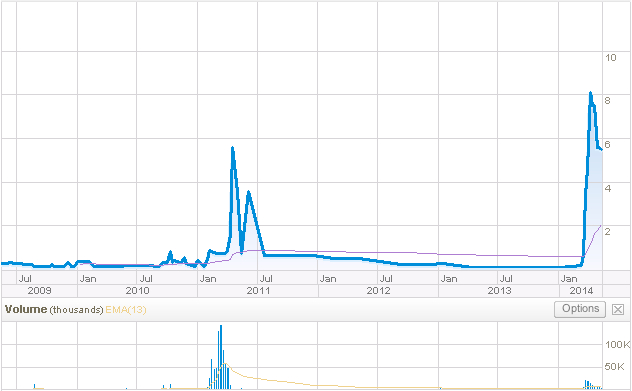

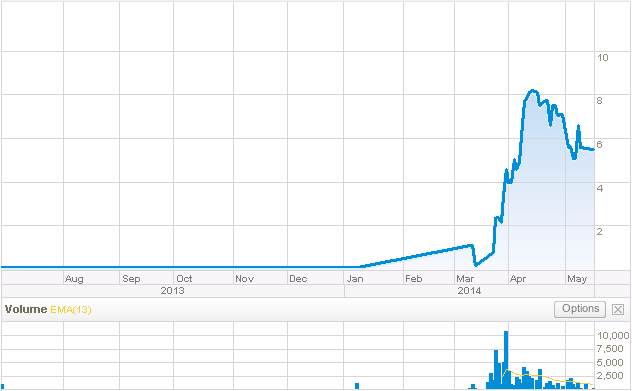

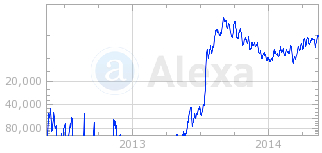

Having said that, their current business venture is also not doing well, at least financially. We know this because, in spite of the large majority of public MLM companies now trying, or preparing, or desperately wanting, to go private – and for good reason – WUN chose to go against the trend and become publicly traded. As a result, they must now consider what’s in the best interest of their shareholders, which is not always consistent with the best interest of their distributors, and they must open their books for all to see. This works great when you’re in momentum (just ask ViSalus), but when things turn ugly, you can’t wear makeup (just ask ViSalus).

Here’s Wake Up Now’s financials since 2009:

| YEAR | SALES | NET LOSS |

| 2009 | $787,428 | -$57,311 |

| 201012 | 1,140,000 | -379,529 |

| 2011 | 1,145,554 | -1,928,688 |

| 2012 | 3,015,142 | -3,302,858 |

| 201313 | 12,180,866 | -4,548,504 |

With sales of over $18 million, WUN has somehow managed to lose over $10 million – and the losses are rising. Even with a quadrupling of revenue from 2012 to 2013, net loses increased by 37.7%. This is especially unusual considering the bulk of their product line is virtual and based on high-margin membership fees. The other products they resell should, for no other reason than basic economies of scale, have greater margins, thus greater profits, as sales increase. Yet, in 2013 their “Cost of Sales” was $11,167,523, or 91.7% of sales.

Current WUN management has said there were some “bumps” and “hiccups” early on and WUN proponents have suggested the previous management “blew through the money.” However, WUN was under new management in August of 2011, and even if we apply all 2011 losses to the previous management, it still amounts to $2,365,528 (77.0% of sales) over three years, and losses of $7,851,362 (51.7% of sales) in the two years since.

WUN has defended this exsanguination14 of cash by asserting funds are being plowed back into the business to expand their infrastructure in preparation for future, massive growth. However, their 2013 financial statement betrays this explanation. Although sales increased from 2011 to 2012 by $1.87 million, and losses increased by $1.37 million, their fixed assets only increased by $392,676 (total assets increased by $205,261 due to all other forms of assets declining). From 2012 to 2013, sales increased by $9.17 million, and net losses increased by $1.25 million, but fixed assets increased by only $236,247 (the majority went to software development). Total assets did more than triple to $2.1 million, but the rest of this was attributed to increases in cash, accounts receivables and loans, inventory ($128,998, most of which would be their skin care products), and prepaid expenses (e.g. advance payments on insurance that hasn’t been completely used up yet). Also, their total liabilities increased from 2012 to 2013 by $3.57 million to $6.74 million.

WUN is expanding, I have no doubt. I’ve seen the videos of the construction being performed to expand their office space, and according to industry advocate, and WUN consultant, Troy Dooly, they went from 30 employees in October of 2013 to over 200 today, and their tech team has expanded from 2 to 20.15 I’m not questioning that some of this huge, growing debt and net losses are due to expansion expenses. But, it really does look like they are borrowing like crazy, raising additional capital via their stock, and successfully increasing sales – which then goes straight through WUN like poop through a pigeon (which is faster than a goose – look it up).

WUN is also expanding internationally, but even this is being performed oddly. As of April 2014, they opened Malaysia and Thailand, which I get. Most of the Pacific Rim is an MLM hotbed. But they also announced “We will be open in Peru, Colombia, Brazil, Chile by convention (September 2014).”16 Regulatory, logistical and market challenges make Peru, Colombia and Chile strange bedfellows. Even Brazil can be challenging (trust me, I know) in that, like all South American countries, there is little regulation of MLM; pyramid schemes are rampant, and bribe– I mean, administration fees can be excessive. On the plus side, Brazil does have the market size, and they’re MLM crazy there, too. And they’ve got Rio.

Although WUN broke out “Distributor Compensation” in their 2009 and 2010 annual financial disclosures (43.2% and 60% of sales respectively), they lumped this expense into “Sales and Marketing” in the three years following. If we consider the entire Cost of Sales (which can’t all be commissions considering this number exceeded sales in 2011) their payout must be significantly less than 71.5% and 91.7% in 2012 and 2013. Even if they are paying out anything close to these amounts, this compensation model clearly isn’t working. In late 2013, CEO Kirby Cochran stated WUN’s profit margin was about 20%. Based on their most recent financials, it’s closer to 8%. Based on the growing pains WUN has weathered over the past year, and their claims of expansion, the last thing they need to do is cut overhead. So, when you’re losing millions of dollars a year, and you’re operating at an 8% margin with the majority of your expenses being commissions, it seems obvious where WUN is going to have to cut to achieve profitability.

MLM companies live and die based on the confidence of their distributor base, and MLM distributors tend to be a fickle, flighty bunch who spook easily. Every bump in the road is Mount Everest and every puff of smoke is a mushroom cloud. That’s why it is never more evident why MLM companies should think twice about going public, and why WUN is so ill-suited to be a public company, than when they are compelled to make public disclosures such as this:

Going Concern – The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. The Company incurred losses of $4,548,504 and $3,302,858 during the years end December 31, 2013 and 2012, respectively. The Company also used significant cash in its operating activities during the years ended December 31, 2012 and 2012. Through December 31, 2013, the Company has accumulated a deficit of $10,401,439 and has a stockholders’ deficit of $4,646,260. At December 31, 2013, the Company has a significant working capital deficit. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. (emphasis added)

The WUN website contains several typos and grammatical or punctuation errors. For example, the subtitle of the “On Demand” section of the Product Suites page, where one may select a few products a la carte, reads, “Get even more value with these something here for placement only and one more thing.” That’s verbatim. Their address on their home page displays a four-digit zip code, and all of the “View Details” links related to their energy products returned a “Page Not Found” error for at least the first four weeks I worked on this review (they’re working now). Their online notice was, “We are currently out of stock, BUT we.” That’s not a typo. Well, at least not mine. This has also since been repaired, but with an even more ominous message. Now the back order notice says “Pre-order now, receive volume credit for this month, and get your Thunder shipped next month.” I have also learned from a reliable inside source that, “WUN sold out of the first run (of Thunder) before it was ready to ship”. That means they must now be, and were, charging credit cards, paying commissions on these charges, then shipping the product weeks later. Not only is this a serious violation of most merchant services agreements (most banks demand product be shipped within 48 hours of the charge), but it creates the impression – and this is only speculation on my part – that they are floating the cash. That is, they need the funds from these pre-orders to fund the next run of the product. Otherwise, why haven’t they fired up the production line weeks ago, back when they saw inventories quickly diminishing? Maybe there’s a reasonable explanation. I don’t know. I wasn’t allowed to ask for one.

“I believe Wake Up Now has the potential to be

one of the most successful (public) companies.”

– Kirby Cochran

If so, they’ve got a lot of work to do.

THE PRODUCTS

Wake Up Now offers one of the most eclectic, hodge-podge of products I have ever seen. From a mobile app to help you track taxable expenses, to discounts on travel and groceries, to jewelry and to energy drinks. Want to learn a new language? They’ve got a course for that. Magazine subscriptions? Got it. Or, how about a commissionable web portal where you can send others to shop from over 5,800 affiliate vendors, and whet your beak a bit on every sale? Yeah, they have that, too.

Awaken Energy Drinks

Let’s start with Awaken Natural Energy, which comes in both liquid (called Thunder) and powder forms (called Tropical Burst and Citrus Rush), and was introduced in March of 2014. Energy drinks were all the rage a few years ago in MLM as they washed over the industry on the same tsunami of “exotic functional beverages” that popularized Noni, Mangosteen, Goji and Acai, along with myriad other fruits, berries, roots, beans, fungi, phytoplankton and asteroid spores (and no, I’m not kidding) that pervaded the industry. While the Jungle Juice craze continues to slide down the other side of the STP coated bell curve, energy drink sales are still rising17. And as Americans become more and more overworked – that’s both Mom and Dad now (us Boomers can remember a day when only one had to have only one job to support a family of five) – and as us Boomers get older, and slower, there’s no reason to believe physical energy will not continue to be a coveted commodity.

I consider myself somewhat of a connoisseur of energy drinks. There’s a guy who delivers my drink of choice, called GoFast (non-MLM), to all the grocery and convenience stores in East Las Vegas. My home is on his route. And no, I’m still not joking. Being physically addicted to them, much like a cigarette smoker is to tobacco, or more accurately, a coffee drinker is to caffeine, I have done a lot of research on this particular type of product in an effort to find the safest, or at least the least harmful, formulation. What I found is that most energy drinks, such as Red Bull, RockStar and Monster, the top three selling brands, contain numerous plant extracts, synthetic vitamins, and amino-acids, along with the obligatory caffeine, sodium, and of course, sugar (often listed as Glucos). Caffeine amounts range from 80 to as high as 500 mg. And that’s just what’s listed as “caffeine” on the can. Then there’s the Guaranå, Ginseng and Green Tea, all of which add more “naturally occurring” caffeine. What also gives several top selling brands their kick are amino acids such as Taurine, L-Tyrodine, and L-Phenylalaline. Such ingredients are not cheap, thus neither are energy drinks. And then there’s the B-vitamins, all of which (mostly B-6 and B-12) are necessary to convert the food we consume into energy.

WUN claims they do not consider other MLM energy drinks as their competitors, but rather the top selling brands in stores. They also like to brag about their $2.00 per 8.4 oz. can price (when purchased in 24 packs) as being among the cheapest on the market. Considering most bands are between $1.75 and $2.25, Awaken’s price is comparable. However, there is a reason for that – it’s among the cheapest formulations. Most energy drinks contain mega-doses of various B-vitamins, from 100% to 8,333% of the Recommended Daily Allowance (RDA) per the FDA, with the majority hovering between 100-250%. Awaken contains 100% of B-5, B-6, and B-12. It’s also on the very low end of caffeine at 80mg. The range among its top selling competitors is 80-200mg. And the only other energy producing ingredient found in Awaken is a modest 50mg of Green Tea, which just adds a little more caffeine. In fact, the only other primary ingredient of any kind is a small 25mg of Chokeberry Extract (which they recently, as wisely, renamed Aronia Berry), which is curious considering I can find nothing attributing the Chokeberry to physical energy production.

To place this in perspective, here is what the Supplement Facts label looks like on an 8 ounce can of my beloved Go Fast18 – which costs about $1.45 when purchased as a 24 pack:

To place this in perspective, here is what the Supplement Facts label looks like on an 8 ounce can of my beloved Go Fast18 – which costs about $1.45 when purchased as a 24 pack:

WUN brags about Awaken having only 10 calories per 8.4 oz. can. Most energy drink brands have low calorie versions, such as Red Bull (13), RockStar (10), Monster (10), XS (8), and even Go Fast (10). In fact, Red Bull now has a “zero calorie” product.

What’s also curious is that Thunder lists their 125mg of Sodium (salt) as being 1% of the “Daily Value” (DV), or the amount you should consume in a day. Sodium is the one ingredient you want to have the least of. However, Red Bull and Monster lists their 100mg (25 mg. lower than Awaken) as being 4% DV (four times higher), RockStar’s 40mg is 2%, and my beloved GoFast lists their 60mg of sodium as being 3% of DV. What’s more, several MLM energy drinks contained 5% to as little as none. But it’s not really the high levels of sodium in Thunder that concern me (125mg is not harmful), it’s their claim that this is a mere 1% of what should be your total daily intake. This may seem like I’m picking nits here, but consider this: A consensus of health organizations, including the FDA, peg the maximum daily recommended amount of sodium to be 2,300mg. So Red Bull, Monster, RockStar and GoFast got it about right. But 125mg is not 1% of 2,300mg, it’s 5.4%. If they are off by over five times on the DV of this ingredient, how reliable is the rest of the supplement label?

And then there are the B-Vitamins – which, for most consumers, do absolutely nothing. Vitamin B will only provide an energy boost to those who suffer from a Vitamin B deficiency. However, due to the abundance of B-Vitamins in our diet, it’s extremely unlikely anyone who can afford to pay even $2.00 for an 8.4-ounce beverage doesn’t already have a diet that supplies them with all of the B-Vitamins they need. And if you’re thinking, ah, but we all have such crappy diets now, and the soil is all depleted of nutrients (which is a myth, but that’s another story), and so on, consider this: A chicken breast from KFC (extra crispy) contains one-third of all the Vitamin B-6 you’ll need that day19, and a Taco Salad from Taco Bell provides about the same for both B-6 and B-1220. You can even get a third of all the B-12 you’ll need from a Big Mac!21

WUN also recently added a coffee product called Arabica Black, which contains Ganoderma. It costs $19.95 (8 CV), but there is no mention anywhere as to the size, or number of servings, even when I clicked on “View Details” (which actually worked). I literally had to find an image of the box and zoom in on it to discover it’s 30 servings.

WUN also offers a line of personal care products that were acquired from the now defunct Trivani. Trivani was a somewhat controversial MLM company co-founded by Dee Mower, ex-wife of Neways and Sisel founder Tom Mower. Trivani was acquired by Ariix in August of 2011, and WUN introduced their new Trivani product line in September of 2013. I’m not entirely clear on how these products made it from Ariix, which is still in business, to WUN. A non-MLM company called Northstar actually has the rights to the line and now has an exclusive agreement with WUN, which now claims that “These are products that have been formulated specifically for WUN.”22 If WUN was going to have their personal care products custom-formulated just for them, why acquire an existing line of products? If these are the same Trivani products, and you want to let people know – because the market believes Trivani has great products – no problem. But, if they have since been reformulated, and these new formulations are exclusive to WUN, then they are no longer Trivani products, yes? They may be even better products now, I understand. But from a marketing standpoint, why brand your products with the name of a dead MLM company, which a previous MLM company has dumped, and whose formulations no longer apply? Alas, such questions will have to remain rhetorical. WUN also adopted Trivani’s “harmful ingredients” campaign which is, for the most part, nothing more than bogus scare tactics.23 To be clear, the marketing of these products are my only issue. Trivani’s products (at least the ones before they were reformulated specifically for WUN) were of good quality.

Another primary product in the line is their “Vacation Club,” which has dropped from a one-time activation fee of $200 to what is now $90. On the up side, there are some good deals here (I did check and compare). On the down side, WUN’s Vacation Club is significantly higher-priced compared to travel club sites like Jetsetter.com, Vacationist.com, and several others, which offer the same “insider deals” and discounts on cruises, hotels, resorts and condos. Most online travel clubs are free (or under $90). What’s more, the WakeUpNow “booking portal,” for hotels and cruises, links to RezServer.com, a public site that posted identical prices whether I accessed it through WUN or went straight to it. There’s also a car rental discount page, which offers the same discounts as countless other online car rental discount sites.

Taxbot is another showcase product, which WUN defines as “one-touch tax relief designed to make it EASY to save thousands on your taxes. The mobile app and online system help save you time, effort, and money. With Taxbot, you can track business mileage automatically with GPS and store receipts quickly by simply taking a picture with your phone.” And that’s accurate. This product was developed by Sandy Botkin, one of the foremost experts in business tax savings. However (you can usually tell how positive or negative one of my reviews are by the number of times I use the word “however”), Taxbot is usuallysold at Taxbot.com for $19.99 a month; however, TaxBot has a current sales promotion for $9.99 per month. It’s sold through WUN for $19.99 a month.Other organizations also have lower priced options24.Some MLM companies offer TaxBot to their distributor base but generally as a business tool25.

Side note: A WUN webinar I watched suggests you use the Taxbot system to keep track of all your deductions during your luxury vacation.26 As Taxbot developer Sandy Botkin would surely agree – don’t do that. You can only deduct business expenses.

Then there’s WUNProtect, “powered by Invisus.” However, it’s not just powered by Invisus, it is Invisus. Same product, for the same $34.95 price you would receive if you just went to Invisus.com.

Same with WUNSpeak, their language training. It used to be powered by TellMeMore, for a one-time fee of $148.85 ($225 with a 35% discount available to anyone). Although their enrollment instruction videos (which are otherwise pretty cool) still list TellMeMore, this product is now powered by Transparent Language, for $29.95 per month, or an annual fee of $199.95. I don’t see anything substantially superior to TellMeMore, but let’s assume you are getting what you pay for. You’ll pay the same thing whether you pay WUN first to get to their site, or just go right to their site.

Next up is the WakeUpNow Finance product, which “simplifies your finances” by placing “all your accounts in one place.” It’s actually a pretty cool system. How… wait for it… ever, it offers practically the same functions as Mint.com, Check.me, Manilla.com, and several other online applications – for free. Although WakeUpNow Finance is seamlessly integrated into the WUN website and appears to be a custom product, it’s actually a product offered by MoneyDesktop.com.27

The Marketplace also includes “WUNDealStream,” which is made up of an odd collection of only 22 very specific brands of products28, seven of them jewelry, and includes color film and a canned foods rack, along with a few obscure branded tech items. I only checked the first five tech items listed, but found no deals. Not only were their “retail” prices grossly inflated, but their “deal” price was beat every time with just a few seconds of Googling.

| Product | “Retail” | WUN | Competitor |

| Dr. Dre Headphones | 279.95 | 189.95 | 169.9529 |

| Slim Sonic Toothbrush | 29.00 | 9.99 | 8.0130 |

| Xtream Bluetooth iPad | 59.99 | 48.00 | 44.3831 |

| NEO-X5 Media Hub | 128.99 | 79.99 | 74.9932 |

| NEO-G4-108C Minix | 79.99 | 64.99 | 47.0333 |

The WUN “Marketplace” offers grocery coupons and “free” items, but once again there are numerous sites on line that offer the same things for free. Just Google “free grocery coupons” or just “free crap”. Seriously, that works!

WUN has also thrown in the “Newsstand,” which provides up to three magazine subscriptions per year. At least that’s worth eight or nine bucks a month.

WUN doesn’t hide the fact that several of these items are free. They openly offer “Dealstream, Discounts, and Cashback” (from the 5,800 affiliate vendors), along with Grocery Coupons and the Travel Booking Portal as “free benefits” to those who enroll as free customers. In this case, the convenience of having all in one place is a benefit considering there is no cost to outweigh it.

Keep in mind, even if you do find a few products that you save a little on, you have to have savings in excess of $100, every month, to make it worth the monthly $99.95 fee.

All of the above is available through the “WUNHub.” The Hub is, “your one-stop shop for exclusive offers for car rentals, hotels, and cell phone discounts… The HUB is a web-based software platform that includes a search engine populated with deals on everything from household products, to vacations, to entertainment, to online offers.”

I started to write that websites that offer coupons, deals and discounts are a dime-a-dozen. But I deleted that. Because it wouldn’t even cost you a dime. For all dozen.

ShopAtHome.com

ExtraBux.com

Ebates.com

FatWallet.com

BeFrugal.com

DealCatcher.com

GottaDeal.com

SlickDeals.net

Offers.com

PriceGrabber.com

NoBetterDeal.com

NerdWallet.com

When it comes to commissionable products – that is, the ones WUN, and your upline, want you to buy, it really comes down to one – The “Platinum” package. This package includes:

• WUN Marketplace

• WUN Protect

• Premium Local Deals & Grocery Coupons

• Corporate Discounts

• Taxbot

• Vacation Club (10 Bookings)

• Newsstand (3 Magazines)

• Finance

• Language

The cost is $99.95 with 90 CV. This works out perfectly since 90 is precisely the amount of personal volume points you need to qualify in the compensation plan. But if you don’t want the Finance and Language products you can buy the “Gold” package for $64.95, which would seem to suggest those two products have a $35.00 value. However, the Gold only gets you 45 points, so you’re going to have to find a retail customer to make up the difference. Of course, you could also go “Silver” for $24.95 if you only want the top three items on the list, and just the CyberWatch part of WUN Protect, but that’s only 8 points. Even if you sell ten more of those, plus your own, you won’t quite qualify. It’s pretty clear they really, really want you to buy the Platinum package.

So here, literally, is the million-dollar question: Is there enough value here to induce a customer, who has no interest in the compensation plan, to pay $99.95 for these items?

Based on my own research, here is what your monthly costs would be if you collected like or very similar versions of each of these products individually:

| Travel Club: | FREE | |

| Market Place: | FREE | |

| Finance: | FREE | |

| TaxBot: | $19.9934 | |

| Invisus (Family plan): | $29.95 | ($14.95 for individual plan)35 |

| Transparent Language: | $29.95 | ($16.66 if paid annually)36 |

| AT&T Discount | ?37 | |

| Three Magazines: | $6.00 | |

| Grocery Coupons: | FREE |

That’s $77.59, or $57.60 if you’re an individual who pays for the language plan annually. So the real question becomes, would a significant number of people, who have no interest in the income opportunity, and only want this product, actually want all of these disparate products, and be willing to pay an extra $22.36 to $42.40 per month ($268.32 to $508.80 annually) for little more than the convenience of having all of these products in close proximately? Keep in mind, even if there is some amount of financial benefit here that is exclusive to WUN members, it would have to be significantly in excess of $268.32 to $508.80 annually for the member to come out ahead.

One prominent WUN supporter has produced his version of their relative value list, which comes out a lot higher than mine, of course. But to accomplish this he only compared travel club costs to those offered by other MLMs, which are a small fraction of all that are available, and among the most costly. He also acknowledges the financial product can be found elsewhere for free, agrees with my values for the Language, Taxbot and Invisus products, so the only way to make the value of a Platinum Package greater than $99.95 is to give a high value to the essentially free Market Place and Grocery Coupon products – or buy three really expensive magazine subscriptions.

In reality, people will much more likely want some of these products, and at different times. So you want to go to Cabo for seven days this summer? It would take almost as much time to do this… http://bit.ly/1it83zF, as it would to log into your WUN account and perform the same search. Same thing if you need to send some flowers, or get a good deal on a new iPad.

And how does a Silver package warrant a monthly fee of $24.95 when Invisus’ CyberWatch program costs $4.95 per month, and a myriad of completely free, local deal, grocery coupon and discount product search engines orbiting cyberspace? Why would anyone ever choose this product? But then, it appears they are not supposed to choose this product.

I’m not at all suggesting these products within these packages are not great products. They’re just not WUN’s products.

“The traditional network marketing company is about selling. No one wants to be sold anything. That make you feel like you’re being cheapened, like someone is going to pull something off on you. We just want to share. We want you to share and let the products and services speak for themselves.”

– Kirby Cochran

There’s no way to rationalize “sharing” something with a retail customer that involves an annual expense of almost $1,200 without it also involving some serious selling skills.

Especially a product that is very likely worth less than $1,200 annually.

THE COMPENSATION PLAN

WUN claims their compensation plan is “patent pending,” and back in December of 2010 actually referred to it as “patented.”38 Although it seems hard to believe, a number of companies and individuals have, in fact, managed to patent their plans.39 However, after searching both patents and patent applications, I can find no evidence that a patent for the WUN plan is even pending.

The plan has gradually morphed over the years, but it’s always been a Unilevel.

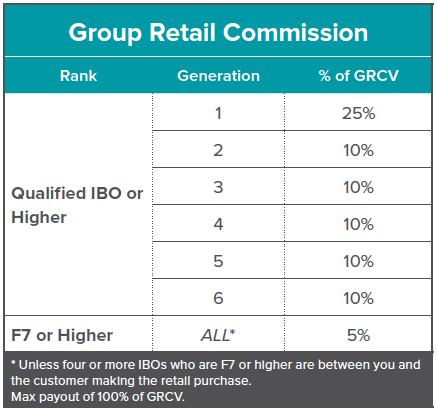

Their “Group Retail Commission” does reward retailing, a little. This unilevel is the payout only on the affiliate products purchased through their web mall, not on Silver, Gold and Platinum packages. The Unilevel pays 25% on the first level, 10% on the next five, plus 5% on an extra generation for those who have reached “Founder 7” (F7) or higher, which pays “all” levels down to the fourth F7 in the line. The fine print states “Max payout of 100% of GRCV.40” However, that’s a mathematically maximum 80% payout just through the first seven levels. So, although this appears as though you can get paid many levels deeper, in reality, this 100% payout cap also caps the number of levels paid on at eleven.41 So it doesn’t keep paying down to four F7s, it can only pay down four more levels.

But, before we go any further, let’s establish what this is 100% of. Because it is not sales volume.

WUN pays on “Volume” points, or Commissionable Volume (CV). They love to talk about their $99.95 Platinum Package because it is worth 90 CV, or 90.2% of the price of the package (90/99.95). Most MLMs use a CV, or BV (Bonus Volume) point system, and the industry average CV-to-price ratio is around 83%42 so, so far so good. But then we get to the $64.95 Gold Package, which carries a CV of 45 (69.3% of the price). Of the $24.95 Silver Package, only eight CV is commissionable. So, although the Silver Package is about one-fourth the price of the Platinum, it will take twelve of them to reach the requisite 90 CV qualifier. But then, at least it’s not early 2012, when the CV of a Silver and Gold Package was 6.25 and 12.5, or most of 2013, when it was 3 CV and 9 CV respectively.

Again, those Group Retail Volumes described above are paid on products that Customers (not IBOs) purchase from the HUB, which will mostly be the retail items they search for (DVDs, clothing, iPads, etc.) that various retailers pay WUN a small affiliate fee for. WUN claims this can be as high as 40%, but that’s a bit deceptive. The vast majority of such affiliate commissions are between 1% and 15%, and average around 5%. And again, that’s what’s paid to WUN, which then sets aside “up to” 50% of this volume (they do not disclose what determines this percentage), then divvies up the remainder via the above described Unilevel.43 So when you see a 10% payout on levels 2 through 6, that’s more likely 10% of (at most) 50% of the 5% affiliate fee paid to WUN, not 10% of the product price.

Awaken is $48.00 for a 24 pack. Yes, that $2.00 per can price is decent, but only half of that $48.00 is commissionable (it’s 24 CV). And the price of a 24-pack is “comparable,” or “competitive,” to store prices, but not actually lower than store prices. A 24-pack of Red Bull is $44.00, and comes with a free flash drive44. A 24-pack of Monster can be had for as little as $29.99 – for 16 oz cans!45 So, it would be tough to make the argument that this price will generate twice as many sales to compensate for the halved commissions.

The Finance and Taxbot products each cost $19.95 per month, but only 5 CV is applied to the compensation plan payout. So basically, you’re only getting paid on a fourth of it. This goes for the two powdered versions of Awaken, too.

The Trivani products have CVs from 6.2% to 40% of the price, and average 32.2%. So you’re only getting paid on less than a third of what sales are made in your downline.

Overall the line averages 35.9% CV-to-Price. But, to be fair, we should apply at least some weighting to the more popular, and higher CV product. That is, they’re surely selling a lot more Platinum packages, where the CV is 90.2% of the price, than Gold packages, where it’s 69.3%, and a lot more Awaken (50%) than Trivani Mouth Rinse (27.4%). So let’s give the Platinum Package quadruple weight, and double the weighting of the Gold Package, the Finance and Taxbot products, and the Awaken beverage line. This isn’t 100% accurate, but certainly more accurate. And if you think the Platinum Package should be given far more weight, because it accounts for “probably 99% of sales,” as one ex-WUN rep guessed, then hold on for the Legal Concerns section below and you’ll understand how I am actually giving them the benefit of the doubt here. This brings the CV-to-Price ratio to 42.1%. To be clear, when CEO Kirby Cochran told a room full of WUN enthusiasts, “We approach 100% payout on our 90% PV… we operate off of a very small margin,” he was referring to only the Platinum Package. That’s it. If you factor in all of their other products you’re getting paid about 100% of 42% of the product cost, which basically makes it a 42% pay out, which is not bad, but on the low side of what is considered a competitive payout (most plans today pay out between 40-50% of actual sales).

And this doesn’t even consider their MarketPlace products which, at the time I checked, all had CVs of between 1 and 3. Yes, that’s a one and a three – like the Dr. Dre Headphones for $279.95, of which 1 CV goes into the plan. Or the Sterling Silver Pearl necklace for $178.00, which is 3 CV. This is what I was referring to earlier regarding the “Retail Commissions” of 10% of 5%. In these two admittedly worst case examples, you’d be paid 10% of either 0.04% or 1.7% of the product price respectively. If you’re having trouble following the math, I’ll help you out. That comes out to a reeeeally small number.

This CV-to-price ratio of 42%, which is about half the volume that average CV using MLM companies pays on, comes into play in an even more impactful way when it comes to qualifying. Stay tuned.

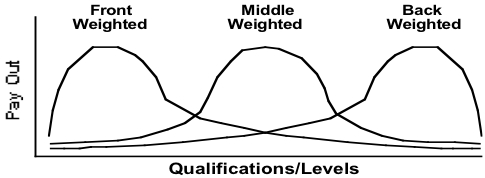

When ever you evaluate a plan, it’s very important that you understand the plan’s “weighting.”

A plan can be front, middle, or back weighted. A front weighted plan spreads the payout more evenly. More participants make money, but those who do make less, on average, because it’s spread more thinly across more people. A “compressed” unilevel plan that pays 40% on the second level (e.g. pays five levels, 5%-40%-3%-2%-%1) would be a front weighted plan. A back weighted plan is one where fewer participants make money, thus those top producers make more due to the concentration of commissions on that smaller group. Most break-away plans, like those used by Nu Skin, Amway, and Shaklee, would be considered back weighted. They have the highest percentage of millionaires, but also the highest percentage of those making no profit at all. Of course, a plan cannot be all things to all people. When you add weight to one part of the plan you must remove weight from another.

A survey of over 7,700 distributors46 and prospects included the question “What is the minimum you would have to earn on a monthly basis for you to consider yourself successful?” The question was further qualified by explaining we were looking for their “primary income goal,” not their “dream goal.” Six percent checked $84,000 (one million per year). Which means 6% still misunderstood the question (it’s likely most would still consider themselves successful if they only made $50,000 per month). Another 8% said they only wanted a “supplemental income” of $200-$300 per month. The remaining 86% were just looking for a “comfortable living income,” which they quantified as between $7,000 to $11,000 per month. Their primary objective when joining an MLM opportunity was to quit their job and live comfortably off of their MLM residuals.

Clearly the vast majority of MLM entrepreneurs are looking for a more balanced, middle weighted plan (although most of them are oblivious to it). In spite of this, the majority of existing compensation plans are not only front or back weighted to some degree, it has become common to heavily weight pay plans to one extreme or the other due to the more attractive hypothetical incomes which they produce. The most common design weights the payout in the form of an hourglass, with the bulk of the payout shifted away from the middle to the front and the back. This is not only a complete contradiction to the optimum weighting for over 86% of the market, it is diametrically opposite of the manner in which downlines form – which is in the shape of a diamond.

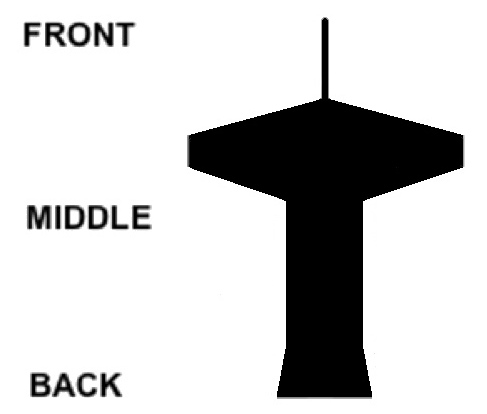

So, where does WUN fall? Is it weighted like a diamond, or an hour glass? Or, perhaps it’s more like an arrowhead pointing downward, with the diamond shaped payout skewed slightly more towards the front, or top. That would be, according to 86% of WUN’s market, ideal. Well, imagine the shape of a push pin. Something kind of like this image to the right.

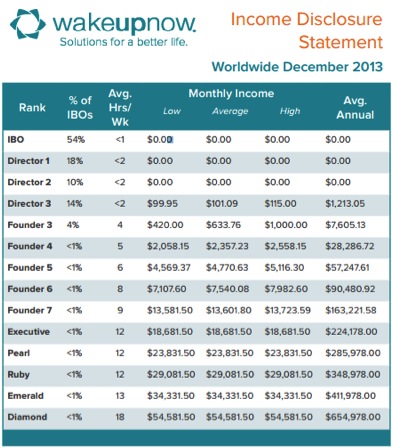

Although, to the plan’s credit, this is a rudimentary form of middle-ish weighting, it’s where they took the pay out from, then where it was added, that bothers me. There’s essentially no very front end, and less in the actual middle, and this appears to be in lieu of extra padding in the front-middle, and on the very back end. In other words (and few sentences deserve to be restated in other words than that one), you get paid nothing upfront, even if you have a small downline under two first level reps, then break even at Director 3 (with three on your front line). But then you get paid a few hundred dollars per month with the fewest distributors I’ve seen in any plan since compressed unilevels were popular in the 90s. If you are among that 8% who desire only a supplemental income, this is a perfect plan for you. However, if you are among the 86% that want a “comfortable, living income” of $7,000 to $11,000 per month, so you can quit your job, you’ll have to achieve at least Founder 6. Not only do a fraction of 1% of all WUN reps achieve this income, less than 1% achieve Founder 4, and all nine ranks above that, combined.

“In fact, out of 800 to 1,000 people who join an average network marketing company today

one person, in aggregate, will make a $1,000 – Wake Up Now is approximately forty-seven times greater than the average network marketing company.”

– Kirby Cochran47

Based on WUN’s Income Disclosure Statement, Mr. Cochran would had to have been referring to lifetime earning. Having said that, Mr. Cochran’s claim that 4.7% (47 out of 1,000) of WUN rep’s eventually earn at least $1,000 is still impressive, on its face. However, 14% earn $99.95 to $115.00 per month, so they would all earn more than $1,000 annually – but make little, if any profits – and 96%, in total, earn this amount or nothing.

Catering to those supplemental income seeking eight-percenters isn’t a bad thing. An extra $600 to $2,000 certainly won’t get you out of your daily commute, but it can be life changing. But again, you can’t make all of the people happy all of the time, especially with MLM comp plans. So while you’re enjoying your few hundred a month, plan on high attrition and turnover (due to the utter lack of income on the way to it), and a much tougher time getting to an income that will allow you to “exit the rat race.”

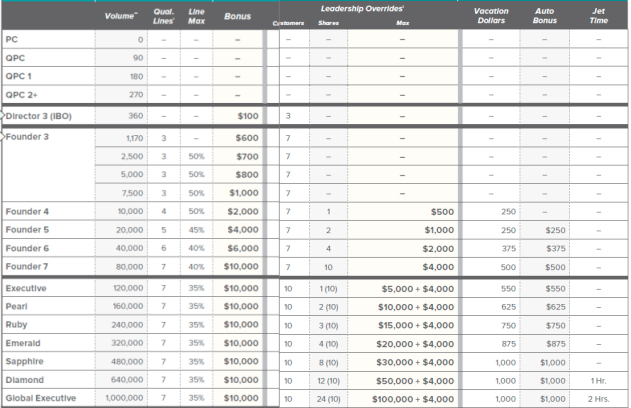

Here’s how the plan works:

To begin qualifying for those Unilevel payouts, or to qualify for any payout, you must first achieve 90 CV in personal purchases, or sales to Preferred or Retail Customer, and sell at least 90 CV worth of product to three customers or IBOs. In other words, buy a Platinum Package and recruit three others who buy a Platinum Package. The large majority of MLM reps in any opportunity never recruit their first person, and rightly deserve no commission. But a much higher percentage do recruit one or two. In WUN, if you sponsor two stars and one or both build substantial groups, you’re paid nothing.

Compensation plans should not be designed to compensate. They should be designed to incentivize. Every aspect of an MLM comp plan should have a good answer to three key questions: 1) How much will this add to the overall payout?; 2) What behaviors does this incentivize?; and 3) Are there any unintended, negative consequences? In WUN’s case, by delaying participation in the compensation plan until a third 90 CV sale is made strongly encourages what’s called “bonus buying.”That is, once you have enough activity below the one or two people you’ve recruited to earn you more than $99.95 per month, you can buy your way into this income by paying for someone’s Platinum Package.

There’s even a greater incentive to do this when we consider the “Director 3” and subsequent “Founders” bonuses. Here’s how those work:

Once you enroll one IBO or customer you are a “Director 1.” Which, again, earns you nothing but the title. When you enroll your second person you get promoted to a “Director 2.” The benefit is that you get to put a “2” at the end of your title instead of a “1.” Those of you who read my Empower Network review48 already know what I think of Aussie Two-up plans49. This is even worse. You not only don’t get paid on your first two, they don’t even roll up to your sponsor!

Once you land your third sale, you become a “Director 3” and earn a monthly $100, which covers your own $99.95 monthly Platinum Package fee. Numerous reps call this a “three and it’s free” bonus, which is not actually true, and a legal no-no. Your income covers the cost, but you’re still paying for it. WUN will tell you that any combination of products can be purchased or sold to reach the requisite 90 CV, but clearly the plan strongly incentivizes, and is based on, everyone buying a Platinum Package. Any other combination of three products won’t get you even close to break even if you’re paying for the Platinum Package. Similarly, if you use any other product combo to achieve 90 personal CV, it will take a lot more than three sales to cover your monthly cost.

When you have at least 1,080 CV in your group, with at least 360 CV in each of your three legs (four WUN-folk who each product 90 CV) you become a “Founder 3,” the $100 Director Bonus cease and desists, and you start earning a $600 Founder Bonus. So, once you come within five Platinum Package sales of achieving the required downline 12, you now have the option of paying $499.75 (for five Platinum Packages for friends or family members) to get a $600 bonus. And Founders get to play in the Group Retail Commissions (Unilevel) now as well. As your legs continue to build, just cancel the PPs you gave your friends or family members as you no longer need them to reach the requisite 12. Yes, this is a scummy, and very legally suspect way to earn the bonus, and yes, WUN’s policies forbid this practice. But their compensation plan is designed to powerfully incentivize this behavior. Unintended consequences.

If you build to a minimum of 2,500 CV (28 Platinum Package sales will get you there, as long as no more than 50% is from one leg), you get a bump to $700 per month. Five-thousand CV earns you $800, and 7,500 CV pays $1,000. Enroll a fourth person who produces 90 CV and produce 10,000 CV in those four legs, and you’re a Founder 4, and earn $2,000. This keeps going to Founder 7 which required 80,000 CV (889 PP sales), no more than 40% of which can come from any of at least seven legs, and you are paid $10,000.

As you can see from the chart below, seven more ranks can be achieved each requiring ascending amounts of group CV, which gets you more shares of Leadership pools and other bonuses (to be discussed in a moment).

One of the challenges with any plan that requires a certain number of reps of a certain rank on your front line, and why I never employ such a feature in any plan I design, is that it introduces a luck factor that can produce rewards wholly out of proportion to production. For example, if I sponsored seven IBOs on my first level, who each sponsored the minimum three to become a Director 3 (i.e. I have 21 IBOs on my second level), and my group produces 640,000 CV, I’m a Diamond. However, if you sponsored 50 on your first level, but only six are Director 3s and the other 44 average 1.5 recruits each (i.e. you have 84 qualified IBOs on your second level), and your group generates over 1.2 million in CV, you’re a Founder 6. You’ve sponsored over seven times as many people, have four times as many PP sales on your second level, and almost twice the total Group Volume, and you are seven ranks lower than me. And if you then buy one Platinum Package out of your own pocket and give it to someone on your second level, you instantly jump seven ranks. Although this example is somewhat extreme, it’s not entirely unrealistic. Nor are the myriad of more common scenarios where the same unfairness, and incentive to bonus buy, occur within such plans.

“Industry average is a buck, maybe 50¢.”

– Online WUN Presentation50

The quote above is referring to the alleged average earnings per distributor. It’s also utterly wrong. I know because I did just such an analysis, albeit backing the late 1990s, and it runs between $2.50 to $5.50. If anything this average has risen since then as MLM product prices have inflated as more companies compete with their comp plans rather than product value (still not the majority, but getting closer). The key factor is the amount of sales volume produced per rep, not the percentages in the plan.

Having said that, WUN’s earnings-per-rep ratio is a healthy $33.33 when you earn your $100 Director bonus on your first three people. Even at the Founder 3 rank, you’re earning $600 on 12 people, which is $50.00 per rep. And no, there’s no “however” lurking in the margins of this paragraph, waiting to strike. At Founder 4 you’re paid another $1,400 on $8,830 of additional volume (16% of volume, or $14.14 per person). This ratio drops to a still impressive $17.86 overall, and at Founder 5 it’s $19.93 overall, Founder 6, $13.48, Founder 7, $11.25, and when you hit Executive it’s still $7.50. And this isn’t even counting the Leadership Overrides and luxury bonuses. Or, the Group Retail Commissions. So sure, if you need some change for the gumball machine, count that, too. Having said that, this healthy income-per-person ratio at these higher ranks is impressive, but offers nothing if you can’t qualify for them.

Leadership Overrides are paid out from a pair of bonus pools. “Up to” 5% of total company CV is poured into the “Founder Override reserve” and “up to” 7.5% goes into the “Executive Override reserve.” The Founder’s pool is paid to all IBOs who qualify for Rank F4 to F7, who each receive an ascending number of shares from one to ten. The Executive pool not only pays an ascending amount of shares, from one to 24, to those who qualify for Executive and above, but each receive ten shares of the Founder’s pool as well. As we’ll discuss in more detail later, WUN is too young to have amassed large numbers of Executives and above yet, but when (if) they do, the stated “maximum” pool earnings at each rank will likely appear silly, and not in a good way. At Founder 4, it’s $500, but eventually this pool is going to get split into so many pieces that a single share will be worth only a few dollars. Let’s assume, for example, that when WUN reaches 100,000 current, active participants, producing an average 90 CV, and with a slightly better breakdown of what percentage of IBOs achieve each rank than they depicted in their most recent Income Disclosure, the Founder Pool will be 450,000 CV, which will be divided by about 29,000 shares. That’s $15.52 per share. And since the size of the pool rises and falls commensurate with the number of shares distributed, this could very well be about what a share is worth right now. Also, contrary to what was stated in a recent WUN training podcast51, the value of these shares will not rise commensurate with overall company CV. As more CV is produced, more IBOs will qualify for more shares, keeping the per share value somewhat consistent over time. So although those big numbers in the “Max” column in the above chart are rich and handsome, much like a Match.com listing, they’re significantly embellished.

The “Luxury Payouts,” which begin at Founder 4 (F4), pay you “Vacation Dollars” from $250 to $1,000, and a car bonus from $250 at F5, up to $1,000. These bonuses are a nice touch, however, you must incur the entire expense first, and then submit your request to have your accumulated “Vacation Dollars” be applied to the expense. For example, if you want to use these Vacation Dollars towards a trip to Hawaii, you must actually go to Hawaii, and incur all of the expenses, then come back and submit your request for reimbursement, and wait up to 30 days to get paid, assuming your trip qualifies (you have to submit proof that you took the trip, including photos and a video telling WUN about your trip). Same with the Auto Bonus. You must buy or lease the car first, then apply for payments. In other words, if you can’t afford a down payment or lease on a new car, or a trip to Hawaii, you still won’t be able to afford it no matter how many Vacation Dollars you have pilling up. Sure, you can put it all on a credit card (assuming you have enough remaining credit), and hope that the company will agree, or be able, to pay you 30 days after you return. And when they are paid their Vacation Dollars (which is likely), will that IBO really use that $3,500 to cover their family’s week in Hawaii, or to pay off that $3,500 they put on their MasterCard? Or have more fun with it? Sure, that’s on them. Absolutely. But why even place your IBOs in this position? Your “Vacation Dollars” are yours. You earned them. I get WUN’s desire to have IBOs really use it for cars and vacations, but why not allow them to pay for it straight out of their Vacation Dollar account?

I also found Mr. Cochran’s recent announcement of a mortgage “payoff” option to be very overstated.52 Previously, if your monthly Luxury Bonus exceeded your car payment you either forfeited the difference, or you could simply increase your car payment to match and pay it off faster. This new option, presented as a big announcement that prematurely leaked, allows those with mortgages to apply this excess to it rather than their car payment. The audience’s reaction was rousing applause. Mine was, so what? So, you have a car payment of $200 and a bonus of $250. Whether you apply the extra $50 to a car payment or a mortgage, it’s still $50 less out of your pocket. This would only offer a benefit to those whose interest rate on their mortgage is higher than the interest on their car payment, and with 30-Year-Fixed now running about 4.4%53, the odds of that are slim.

There’s more goofy stuff going on here. When you submit your first request for Vacation Dollars, a compulsory $250 is used to purchase and send you the “WUN Adventure Kit,” which includes a backpack, GoPro® action camera, and some “great WakeUpNow SWAG to sport on your travels” – even if you neither want nor need any of this. Also, once you start using Vacation Dollar funds you are required to use them to purchase at least two tickets to the Annual WakeUpNow Corporate Conference. Allowing them to use Vaca Bucks (that’s what the kids would all them nowa days) to cover event tickets is great. Forcing them to, not so much. Also, IBOs with a rank of F7 up to Pearl are required to use Vacation Dollars for at least one corporate Escape Trip per year. If you decline, the full price of these conference tickets will be deducted from your Vacation Dollar account anyway. And finally, whenever new Vacation Dollars are earned they only “accrue” for three months, then expire! Put another way, when you are able to take a vacation, you can only use the Vacation Dollars you’ve earned in the last three months.54

On the plus side, you do have the option of gifting the event tickets to someone else, and in the case of the Auto Bonus, you can elect to take 50% of the Vacation Dollar bonus in lieu of a car payment. Both are better than nothing.

In October of 2013, WUN added a “Customer” qualifier to each rank of the plan. Director 3s not only need to enroll three IBOs, but also must enroll three Customers. A Founder 3-7 requires seven Customers, and an Executive and above requires 10. WUN defines these Customers as “Preferred Customers, Insiders, customers who checkout or redeem shared deals as a guest, really any customer who purchases retail product.” However, an “Insider” is defined as, “A Deal Stream Insider is a member who subscribes to WakeUpNow marketing messages and deals, typically via social sharing,”55 and guests need only “check out” the shared deals to count. What’s more, even IBOs who have not yet reached Director 3 count as “customers,” as do those who enroll and choose to not purchase anything56. So, which activity does this more strongly incentivize? Acquiring new retail customers, or getting a few friends to sign up for free?

I’m also curious to know how Founders are protected from having seven “Customers” and then one of them enrolling as an IBO without the Founder’s knowledge (and leaving them one short of the required 7)? This creates the unintended consequence of not wanting your Customers to become IBOs. At least, not on a Friday.

Now, after all those volume qualifiers have been described, let’s revisit that 42% CV-to-price ratio. Remember those three people you had to enroll who each have 90 CV to be a D3 and earn the $100 bonus? Or the 1,080 CV over three legs to get to F3 and join the “$600 Club?” Or the 80,000 CV to qualify for F7, or the 1 million CV to achieve Global Executive? Now, giving WUN every benefit of the doubt – that is, as they claim, they are not just pushing Platinum Packages to everyone to qualify, but indeed are “sharing” a wide variety of individual products of value – and thus assuming my weighted average57 of 42% is more in tune with reality, it will actually require about $855 in sales to achieve 360 CV, $1,425 in sales to get to 600 CV, $2,565 will produce 1,080 CV, and you’ll have to amass $190,024 in sales to get to Founder 7 (assuming it’s all spread out in the correct structure). To achieve their highest rank of Global Executive plan on your group producing around $2.37 million. Which probably explains why no one has ever qualified of this rank. At least, not yet.

Bottom Line: CV is not sales.Whatever ratio you want to use, it’s going to take significantly more sales than these CV qualifiers suggest.

WUN is among the growing number, but still minority, of MLM companies who publish an Income Disclosure Statement. As with all such statements, they’re hard to fall in love with at first sight. They tend to reveal a very large percentage of reps earning little or nothing, and a disproportionate percentage earning the largest incomes. Of course, that’s because the large majority of MLM reps, or human beings for that matter, tend to not apply nearly enough effort, for not nearly enough time, to succeed. That’s why the income distribution of Americans in general looks very similar to an MLM company’s income distribution58. But, this is a rant for another day.

In WUN’s case they show 54% of IBOs as not even achieving Director 1 (haven’t enrolled one person), and 18% have achieved D1. Another 10% achieved D2, and 14% made it into the money by achieving Director 3. Unlike all previous quarterly disclosures the 82% that were below a D3 made absolutely nothing. Zero. D3s earned an average $101.90, which would be their $100 Director bonus and some gumball money from the Group Retail Commissions.

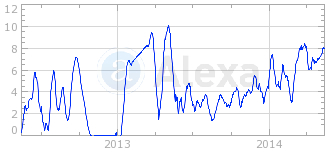

When analyzing commission trends since their Q2 2013 statement (the last three published) I found it curious that all average incomes from Founder 3 and above are slightly trending down, while the percentage of IBOs below D3, and earning nothing, has slightly ticked up. As an MLM company grows, as WUN has been in recent months, average incomes should be slowly rising across the board.

Although WUN does not report the number of IBOs at each rank, when the “low,” “average,” and “high” incomes are all identical, it’s not hard to figure out that there’s one person at that rank. This was the case for Founder 7 and Pearl (the highest rank anyone achieved) in the second quarter of 2013. That’s nothing unusual, especially for a young, pre-momentum company. However, in their August 2013 statement, they had one Executive, at least three Pearls, no Rubies, and a single Emerald and Sapphire. By the end of December, they had one each of Executive, Pearl, Ruby, and Emerald, zero Sapphires, and one Diamond. Granted their Q1 2014 Disclosure isn’t out yet, but considering they’ve been celebrating their strong growth since the middle of last year, and are now claiming to have amassed “over 100,000 customers,”59 there seems to be a dearth of participants partaking in the higher ranks of the plan. Not that there isn’t a very robust back end to the plan. In fact, the back end is loaded. However, very few reps seem to be able to get to it.

Included on all WUN Income Disclosure Statements are the number of average hours per week that each ranks spends on their business. Although they appear to be somewhat arbitrary, WUN claims these numbers are derived from “estimating and surveying,”60 but no sample size is revealed. For example, the Statement suggests Directors 1 and 2 each spend fewer than two hours per week building their WUN business, as does a Director 3, inspite of the $500 monthly increase in commissions if they were to advance one more rank to Founder 3, and with a mere nine additional Platinum Package sales. Founder 3s should be the most active rank on the chart. Even the top six ranks spend only 9-18 hours a week on generating their average $13,602 to $54,582 per month. To put this in perspective, the DSA’s research shows about 10% of all reps work “full time” on their businesses61, and other credible sources peg the “full time” workers among all direct sellers (not just MLM) at 30%62, or show 12% of MLMers working over 20 hours (and 45% work 5-15)63, and the average per week for all active distributors is 16.8 (mean is 12)64. Methinks the “Avg. Hrs/Wk” column is inaccurate, and creates an unrealistic expectation as to the time it will take to achieve these incomes.

To their credit, VP of Sales & Training Andy Benis and VP of Marketing Jordan Harris get it right. When addressing those who might receive the survey, Harris pleads, “We really do want honest answers. We don’t want anyone coming into this with false notions about how long it takes”.65 Benis goes on to mock the claim, “Hey, I’m a Founder 7 and I only work 10 hours a week.” He continues, “I guarantee there is probably not a single Founder 7 in this company worth their salt that only works that many hours a week today… if you’re going to rank up, you’re going to do more that that.”

Too bad their Income Disclosure Statement, which suggests Founder 7s only work 9 hours a week, isn’t as candid and forthcoming.

WUN claims the primary means by which they manage these $100 bonuses on three $99.95 enrollments/sales, or $600 on 12, is that they “operate off of a very small margin.”66 This will be discussed in more detail in the Legal section below, but for now, let’s take a look at their “Gross Margins” as a percentage of Total Sales.67

| Total | Cost of | Gross | |

| Sales | Sales | Margin | |

| 2009 | $787,428 | $426,969 | 45.8% |

| 2010 | 1,140,000 | 710,132 | 37.7% |

| 2011 | 1,145,554 | 1,284,745 | -12.2% |

| 2012 | 3,015,142 | 2,155,138 | 28.5% |

| 2013 | 12,180,866 | 11,167,523 | 8.3% |

I do like the larger per-member payouts from D3 to F7, but there’s a trade off for these gaudy ratios. If you only enroll two, no matter how many they enroll, your earnings-per-member is zero. Build a 2×2 downline of 1,000 people and the combined earnings of all of them would be zero! Yes, I know that’s perfect math, and that’s ridiculous. But any plan is flawed if all participants enroll only about the average number of recruits and no one makes a penny. And that’s based on the optimistically flawed, but generally accepted average of 2.6 recruits per distributor.68 Consider this, if ten distributors are surveyed and nine sponsor none and one sponsors 20, the average is two, even though no one enrolled two people. In reality, this 2.6 average is generated by a mass of participants enrolling zero, one or two, and a very small percentage enrolling three or more.

Overall, it’s hard not to like a plan that at least tries to be middle weighted. The WUN plan does, and succeeds to a degree. But again, wherever you shift the payout to, you have to shift it from somewhere else.

In spite of the high “however” count, I’d actually give this plan a solid B. It’s kind of like last Thanksgiving when I decided I was going to take the burden off of my elderly mom by doing all the baking for her. By popular demand, I made six pumpkin pies, diligently following her recipe to the letter. Except I forgot the sugar. The intent to do the right thing was there, but the execution was very flawed. Kind of like the Wake Up Now compensation plan.

THE POLICIES & PROCEDURES

The WUN P&Ps are not particularly unusual. It contains much of what can be found in most MLM P&Ps. Not that this isn’t troublesome, it’s just not unusually so.

First, the good news. Their compliance section is one of the best I’ve seen. In this case they are unusual in that they don’t just say “don’t make income claims” or “if you make an income claim include the disclaimer” (I’m paraphrasing). They actually go into detail about what exactly you can and can’t say and under what circumstances. For example, they describe “lifestyle” and “hypothetical” claims as being the same thing, from a regulatory standpoint, as an income claim, and thus requires the same disclosure. And, unlike many MLMs today, they seem to have been well educated on the difference between a disclaimer and a disclosure. The FTC changed the rules a few years ago where a disclaimer (e.g. “results not typical” in fine print) is no longer acceptable. Now you need a full, prominently displayed, Income Disclosure (or link to one) that declares what results are typical. Which explains why WUN, and a growing collection of other MLMs, are now producing these Income Disclosure statements.

Now if WUN could just get more of their reps to actually read their P&Ps, and adhere to this guidance, that would be even better. Because, with some exceptions, it doesn’t appear as if they are doing so. Although there are surprisingly few (relatively speaking) blatant income claims sans any disclosure, the income claims I’ve seen often include only a brief, way too subtle, disclaimer, not a prominent link to the Income Disclosure. However, corporate produced material does it right (see, not every “however” is bad). Even small meetings where Mr. Cochran spoke (on video) and made income or lifestyle claims, he did provide the proper disclosure, and used it as a teaching moment.69 In the same presentation he stated, “I live, drink regulatory.”70 When it comes to income claims, I’d like to see their reps use their disclosure statement more, and in a more compliant way (most who use it online are not making the link prominent enough), but in this one regulatory area WUN is ahead of most MLM programs. However, that’s a much larger area than just income claims.

WUN does include an atypical policy against poaching reps from other MLMs. If you try to pirate your own WUN downline into another MLM that’s a terminatable offence, of course. But section 4.11 titled “Targeting Other Direct Sellers” only states WUN does not “condone” it. What’s the penalty for engaging in such activity? You “bear the risk of being sued by the other direct sales company.” And if you are, “WAKEUPNOW will not pay any of IBOs defense costs or legal fees, nor will WAKEUPNOW indemnify the IBO for any judgment, award, or settlement” (emphasis original). What’s odd about this is that it is extremely rare that the company is not also named in such lawsuits. If it were me, I’d actually make such activity a policy violation, not something that’s just not “condoned,” but tacitly allowed – because it does appear a lot of their new reps are coming from other network marketing companies.

A policy that is not unusual, but which I abhor, are those that require “Continuing Development Obligations” (5.2), “Ongoing Training” (5.2.1), “Increased Training Responsibilities” (5.2.2), and “Ongoing Sales Responsibilities” (5.2.3). These are fine when a retirement clause is included that overrides these requirements, but I’ve only seen such a clause in about a dozen P&Ps – the ones I wrote. Without such a clause, how does one retire and live off of their “residual income” without violating their company’s P&Ps?

An unusual policy I like is 8.3, which states an IBO “will not be terminated for merely requesting a refund…” Most companies will.

However, 8.1 provides for only the federally mandated three day refund period (5 days in Alaska) to get a full refund on all monthly auto-pay products, then a 75% refund from 4 to 7 days beyond the charge, plus a 10% service fee. After seven days there are no refunds. This would include the Platinum, Gold and Silver packages, and most components if purchased a la carte. Several states, including Georgia, Massachusetts, Wyoming, Maryland, Louisiana, Montana, Oklahoma, and Texas, as well as The State Without a Star (Puerto Rico), all have their own refund policies that MLM operations are required to adhere to, each requiring at least 30 days, and most 9071. Also, how could any bona fide customer of these products even begin to assess the value of these products in a mere three days? Or, even seven? Of course, if you’re just buying a Platinum Package to qualify, then this makes perfect sense.

Section 8.4 breaks down how refunds are clawed back from the immediate upline when a refund or chargeback occurs after commissions have been run. Note, I said the refund is clawed back, not commissions paid. That is, the entire price of the product is recouped by WUN from the pockets of their IBOs, as if the refund never occurred! So WUN still gets their money, but now pays very little, in any, commissions on it. In addition to this prorated “refund liability” to those IBOs five levels above the refund (from 30% to 10%, depending on how many levels the IBO is above the refund), WUN also charges a $100 “service fee” – to all five of them! Think about what behavior that incentivizes? If someone you sponsored is about to ask for a refund on a $99.95 Platinum Package, and you knew you were going to get hit with a deduction of 30% of that ($29.99) plus a $100 fee, is there any way you’re not going to cover their $99.95 fee? I can see no other reason for WUN clawing back the entire purchase price of the product (not just the commissions paid) from those five levels upline, plus gouging them for another $500, than to incentive eliminating refunds and charge backs in this manner.

WUN can also warn, fine, suspend, or terminate IBOs for “any illegal, fraudulent, deceptive or unethical business conduct, or any act or omission by an IBO that, in the sole discretion of the Company may damage its reputation or goodwill (such damaging act or omission need not be related to the IBOs WAKEUPNOW business).” In other words, for doing things that are not necessarily illegal, or even in violation of their policies, and may not even have anything whatsoever to do with Wake Up Now. Sure, a lot of MLMs have this in their P&Ps. That doesn’t make it right.

WUN also has a mandatory arbitration clause (9.4) where the IBO “waive rights to trial by jury or to any court.” According to the 9th Circuit Court (Pokorny v. Quixtar)72 such a clause is not enforceable.

Section 10.3. entitled, “Sales Taxes” states, “WAKEUPNOW is required to charge sales taxes on all purchases made by IBOs and Customers, and remit the taxes charged to the respective states. Accordingly, WAKEUPNOW will collect and remit sales taxes on behalf of IBOs, based on the suggested retail price of the products, according to applicable tax rates in the state or province to which the shipment is destined.” The problem is, WUN doesn’t do any of this. They have no “suggested retail price” on any of their products, and they don’t charge sales taxes on any products outside of Utah.

One of the most poorly thought out policies is 11.2.1 “Failure to Meet CV Quota,” under the “Cancellation Due to Inactivity” section, which states, “If an IBO fails to generate sales of at least 300 CV every six months, his or her IBO Agreement shall be canceled for inactivity.” So, what if you sell one Gold Package in January, February and March, and both a Gold and Silver package in April, May and June? That’s monthly CVs of 45-45-45-53-53-53, for a total of 294 CV – and you’re terminated for “inactivity”? They should change the title of this section to “Buy a Platinum Package or Else!”

One of the most potentially harmful, yet most ignored policies in any company’s P&Ps is the one that says, “An IBO may also voluntarily cancel his or her IBO Agreement by failing to renew the Agreement on its anniversary date or by failing to pay his / her monthly website fee. The Company may also elect not to renew an IBOs Agreement upon its anniversary date.” Seems pretty innocuous, right? It just says you can quit by simply not renewing your annual distributorship. Except, it also says “The Company may also elect not to renew an IBOs Agreement upon its anniversary date.” Many MLMs have such “renewable by the agreement of both parties” type of language. There are two potential “gotchas” here, and they are so subtle most companies don’t even understand what kind of power it provides them. First, it gives WUN the ability to terminate you on your anniversary date for absolutely no reason. They just refuse to renew you. Secondly, what if you ever are wrongfully terminated, you sue, and you win? Let’s say you joined in January of 2010, were terminated in November of 2010, were declared wrongfully terminated in May of 2014, and the Jury awards you back commissions. But not for November of 2010 through May of 2014, but rather only for November and December of 2010! Your distributor agreement obviously would not have been renewed by the company in January, your anniversary month, so a clause like this acts like a circuit breaker for damage awards. And this is not theory. There’s legal precedence.73)

Please understand that I’m not at all suggesting that WUN management are such scoundrels that they deliberately placed all these booby traps in their P&Ps. A lot of this is just boilerplate verbiage that gets cookie-cuttered from company to company. But some of this is unique to WUN, and can best be described as draconian.

LEGAL CONCERNS

Let’s work from small to big.

The BBB report on WUN is relatively negative. They have a grade of “C,” which can be quickly changed to at least an A- by simply paying the $600 to go through their fairly simple “accreditation” process. They’ve received 49 complaints in the last 12 months (up from 42 just a couple of weeks ago), most dealing with refund/billing and product/service issues. To place this in perspective, the current top 15 MLM BBB complaint receivers over the past 12 months are:

| North American Power | 353 |

| Momentis | 231 |

| Ambit | 157 |

| Stream Energy | 151 |

| Melaleuca | 116 |

| Empower Network | 101 |

| ACN | 88 |

| Avon | 79 |

| Viridian | 74 |

| Primerica | 56 |

| Nerium | 55 |

| Wake Up Now | 49 |

| LegalShield | 45 |

| ViSalus | 41 |

| Tupperware | 37 |

Gas & Electric companies are listed in red. If you’re curious, Herbalife has 13. So other than energy companies, which are always bombarded with slamming complaints, WUN’s 49 complaints ranks 6th. MonaVie, Nu Skin, XanGo, Zrii, Send Out Cards, Morinda, Neways, Shaklee, Agel, USANA, Mannatech, Vemma, Purium, ForeverGreen, Youngevity, Gano Excel, Yoli, Freelife, Life Force, Reliv, and Amway also have 49 complaints – combined.

To their credit, they have made the appropriate effort to resolve all 49 complaints. How a company handles their complaints is actually more important than the raw number of them.

Transparency & Disclosure

WUN management tends to overplay the “we’re so transparent” angle. An Employer Identification Number (EIN) is required of all corporations, or businesses with employees. This is public information that can be used to verify certain regulatory filings (and the fact they even have an EIN number). In fact, it should appear on every 1099 form WUN sent out last January, so it’s not a secret. Yet, it does not appear within either of their annual disclosures, within any of their corporation documents74, nor within several public EIN databases. If you want to join WUN under a business entity they require that you provide them both your social security number and your EIN.75 But when I asked them for this number, I was first told that the only two people who could provide it were in Asia (actually, there would have been several in their accounting office). After two weeks I asked again, and my request was denied. A reason was provided, but within a “privileged and confidential” email that I am not at liberty to quote. WUN has been recently attacked by other industry critics using their public disclosures. It would make sense that they are reluctant to provide them any more fodder. Now, read between those last two lines.